Promotional Features

Considering Ashwagandha? 6 Reasons Why only Root is Best (Part III of III)

Previously, we detailed four immutable reasons why the root of Ashwagandha (Withania somnifera) is the part of the plant that can be used successfully for formulas that will fulfill consumers’ expectations. The first four were:

The remaining two complete the profile of the power of Ashwagandha root and will be elaborated upon here: peerless market potential and barrier from economic adulteration.

5. Market Potential

To see how ashwagandha dominates the world’s consumption of dietary supplements, let’s look at the swelling tide of supplement use throughout the globe: according to Precedence Research (“Dietary Supplements Market Size, Report 2021 to 2030”), The global dietary supplements market size was valued at $141.2 billion in 2020 and expected to reach $279.2 billion by 2030.

This astonishing figure encompasses all manner of sales outlets –- but of course, the behemoth is Amazon, which is not expected to slow or fizzle but grow even larger as a retailer. Supplements featuring or containing Ashwagandha roots are commanding sales on Amazon.

The increase in consumers flocking to eCommerce during the COVID-19 pandemic, coupled with the demand for natural products supporting anxiety, sleep and stress relief, has caused ashwagandha supplements to experience an incredible sales boom on Amazon. With Amazon encompassing upwards of 70% of online ashwagandha supplement sales today, the channel cannot be ignored and is an increasingly critical source for revealing consumer and product purchasing trends.

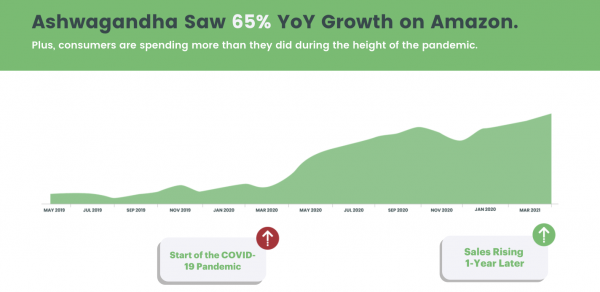

Ashwagandha supplements saw incredible year-over-year growth.

Ashwagandha supplements experienced a 65% YoY growth rate on Amazon, an impressive statistic in relation to other supplement categories’ growth rates on the marketplace. These gains are partially due to the pandemic which has driven consumers to shop online, but even moving into the second quarter of 2021, consumers are still spending the same (or more) as they did during the height of the pandemic (please see table 1 below).

Consumers are demanding Ashwagandha sourced only from roots.

Another remarkable insight from Amazon is that 97% of ashwagandha sold on the marketplace is made from the roots. The other 3% is made from a combination of roots and leaves or just leaves. Furthermore, ashwagandha products made from the roots grew by 64% year-over-year, or at about the same rate as the overall category.

Another important insight is that Ashwagandha products sourced from the roots are sold at a slightly higher average price ($17.23) than those made from a combination of roots and leaves ($15.45). Despite the premium, consumers are still willing to pay for products derived from roots.

The fastest-growing Ashwagandha products include KSM-66 extract.

Every single one of the top 20 best-selling Ashwagandha products on Amazon are made from roots; most Ashwagandha products sold are capsules and promote stress and anxiety relief.

One of the most notable insights about the top-selling products is that those marketing KSM-66 extract as a key element of their formulations saw some of the highest year-over-year growth rates. One product with KSM-66 saw a growth rate of 490%, while another saw a growth rate of 135%, far outpacing overall category growth. This insight is particularly important, as it likely underscores the continued rise of KSM-66 as a “hot” inclusion within Ashwagandha products.

The top 20 brands only sell products sourced from roots.

Of the more than 100 brands selling Ashwagandha products on Amazon, the top 20 only sell ashwagandha supplements made from the roots. There was also a notable new entrant to the top 10 ashwagandha brands in the last 12 months which brought in over $1M in sales from a single product made from only roots.

It is clear that ashwagandha supplements made from roots are preferred by consumers. Further, there is still room for brands to enter the Ashwagandha market to introduce innovative products, based on irrefutable evidence of a growing category, the rise of new entrants, and the demand for ashwagandha roots – particularly KSM-66 extract.

6. Barrier from Economic Adulteration

Ashwagandha is rapidly becoming one of the world’s most valuable medicinal plants. The global interest in this herb and the high demand for its roots provide an ample scope to cultivate this plant on a commercial scale. As the demand increases, it puts pressure on the supply chain, thus leading to adulteration.

Adulteration is a nefarious act that can have dramatic, harmful effects or render the product inactive and therefore ineffective. Botanical products when adulterated usually contain other plant parts, other plant species, or synthetic additives.

In such an attractive market as botanical-based supplements, there exists potential threat of what the Natural Products Association has called “economic adulteration.” Economic adulteration is defined as “the fraudulent, deliberate substitution or addition of less safe and less expensive ingredients in a product to increase the apparent value of the product or reduce the cost of production, i.e., for economic gain."

The American Botanical Council recently published a Botanical Adulterants Prevention Program (BAPP) Bulletin, "Ashwagandha Root and Root Extract," drawing attention to some suppliers engaging in surreptitious substitution of the root constituents in ashwagandha. This kind of incorporation of non-root parts such as stems, flowering parts, and mostly the leaves to the root accounts for most of the adulteration.

Ashwagandha leaves create an undesirable product.

Using ashwagandha leaves may boost profits greatly for those manufacturers but departs from mainstream Ayurveda practice and current scientific literature. Leaves are significantly inferior and less expensive, often one-fifteenth to one-twentieth the price of the roots.

Manufacturers are unscrupulously adding leaves to roots to increase the withanolide content. However: not all withanolides are beneficial for human health. Using leaves spikes up the overall withanolide content, but it also brings in the undesirable withanolide Withaferin A, which has been established in multiple studies to be cytotoxic. Therefore, it is undesirable to have Withaferin A in an Ashwagandha extract when the intended use is for classical applications like building anti-stress ability, energy, cognition, and immunity.

Conclusion

The market remains hot for development of products featuring ashwagandha root and root extracts. The six reasons – traditional use, modern research, strong portfolio of global regulatory approvals and global pharmacopeia references, market potential and protection against economic adulteration pave the road for success in the natural health market with KSM-66 Ashwagandha root extract.

In our next editions of Ashwagandha Insights, we will discuss a range of pertinent topics supporting the use of Ashwagandha roots, such as quality control, supply chain, traceability, applications, KSM-66 market success, and its innovative use in a variety of products.