The long tail of TikTok: What recent history teaches us about berberine & taurine

There are obvious comparisons between TikTok and the old “Dr Oz Effect”: Content featuring specific ingredients or products spark a sudden boom for the industry, whether supported by the science or not. However, TikTok is not a direct replacement for the now defunct Dr Oz Show, said Jim Emme, CEO of NOW.

“TikTok does appear to have more of a lasting effect that Dr Oz, which was one and done,” Emme told NutraIngredients-USA. “TikTok is out there, you can search it again and again and keep finding things.”

A good example of this is “liquid chlorophyll”, which sparked a TikTok craze in 2021 and led to shortages across the US. “That shook the global supply chain,” said Emme. But unlike a Dr Oz “burn-brightly-and-then-fade” situation, interest in liquid chlorophyll has remained, he added. “That bump has only gone down 10-15%.”

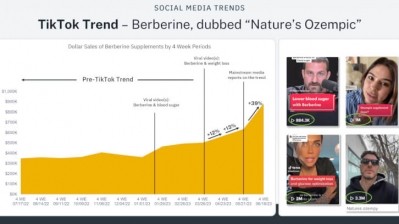

“How long do the TikTok trends last? They do come back down but almost always at a level higher than pre-TikTok,” said Scott Dicker, Market Insights Director at SPINS.

Taurine and berberine

More recently, taurine surged following a study in Science linking the ingredient to aging, and supplementation with a 12% increase in healthy lifespan (for animals at least).

Emme told us that, compared to sales over the prior two years, NOW has recorded sales increases over the past three to four weeks of about 300%. Specifically, the company offers three different taurine SKUs, and individually they are up 274%, 300%, and 353%, he said.

Another recent blockbuster is berberine. “Until we ran out of stock, sales were up 623% from those early reports,” said Emme. “Through Fruitful Yield [NOW’s Chicagoland-based health food stores], we’re hearing that everyone is out right now.”

While interest in taurine was sparked by a scientific paper in a top-tier peer-review journal, the driver behind the recent TikTok interest in berberine is more troublesome.

It all relates to Ozempic, Novo Nordisk’s prescription drug for diabetes. One effect of the medication is weight loss, which led to Novo Nordisk seeking approval for the active ingredient as a weight loss drug from the FDA under the brand name Wegovy. Hollywood celebrities jumped on the Ozempic-for-weight-loss bandwagon, boosting consumer interest in the drug.

The link to berberine stems from its blood sugar management/ glycemic control effects, which is Ozempic’s main function. Meta-analyses support berberine’s glucose support potential, with the data also showing improvements in BMI (for example: Guo et al. 2021, Oxid Med Cell Longev.) TikTokers began hailing the botanical as ‘Nature’s Ozempic’, leading to a surge in consumer demand for berberine dietary supplements.

Emme stressed that NOW has been selling berberine for years and only makes structure-function claims relating to glucose support. Other brands in the marketplace also reference the botanical’s potential benefits for supporting healthy cholesterol levels.

Changing the model…

Loren Israelsen, President of the United Natural Products Alliance, noted: “It’s the same problem then as now: Somebody says something – Dr Oz, Oprah same deal – and boom, sudden demand. One of the differences historically, unlike now, is that that companies had big broad lines. They were servicing the mom and pop health stores that really insisted on making sure they had what their faithful customer really wanted.

“The ethical problem is that now we see what’s going on on TikTok, there will be a scramble and many people are trying to get in super fast. It’s going to be sloppy. It does not support a thoughtful, high-quality marketplace, and if it persists it is really going to change the model."

Such a model will also lead to a diversion of R&D focus, he said. “You are going to have companies with big time FOMO, looking at others make big money in a short time. Why would companies spend a lot of money on R&D and developing a new and legitimately-researched product when everyone’s in another place buying something that’s trending on TikTok? And that’s a bad thing.”

Similar conversations are happening in corporate boardrooms across many industries. A recent article in the Wall Street Journal with the headline, “American Companies Held Hostage by the Whims of TikTok” noted, “The social-media giant has become ‘a billion-person focus group,’ disrupting business cycles and upending corporate R&D.”

“Most everyone will follow the money, and it’s going to be a question of who can jump in first,” added Israelsen.

“The new model is probably going to have people constantly watching TikTok trying to figure out if something is about to pop,” he added.

“Brands and ingredient suppliers are in reaction mode”

Regardless of the whatever drives a surge, TikTok is adding to the complicated supply picture that many companies in the dietary supplements space are navigating. “Since COVID, all brands and ingredient suppliers are in reaction mode,” said Emme. “Forecasts are not what they used to be.”

Some companies like The Vitamin Shoppe have dedicated teams to keep a finger on the social media pulse. Lisa Chudnofsky, the retailer’s VP of Brand, Content and Creative, told the NutraCast last year: “I spend an extreme amount of time on these [social media] channels reading comments and sifting through the good, the bad, the ugly, and I will say TikTok is a really great indicator of what's going to happen next, but it's really hard to anticipate. Something will come along, and you go, ‘Wait, I was not expecting that’ and luckily we sell a lot of different things.”

It's that breadth of products that appears to be key, said NOW’s Emme: “With 1,400 SKUs, we’ll catch the lightning bolt once in a while.”