Exploring the pediatric microbiome

As awareness of the gut microbiome’s critical role in health continues to grow, so does the need for age to be considered when identifying preventive or therapeutic solutions.

While earlier reports suggested that the infant microbiota would attain an adult-like structure at the age of 3 years, more recent studies have suggested that microbiota development may take longer. The timing of this development is key because there is growing evidence to suggest that fluctuations in this development may have consequences in later life.

With that in mind, a growing number of brands are looking to adolescents as a means to provide opportunities for microbiota-based interventions to promote health or prevent dysbiosis.

Age gap

“What you typically find is that there's so much research on the early stages of life. So in infancy, you see a lot of research in human milk, oligosaccharides, the role of breastfeeding, microbial exposure during infancy in the first two years of life while the microbiome is developing into steady state and then there's a lot of research that's focused on adults and the later stage, particularly in relationship to pathogenesis or to disease or to areas or indications of dysbiosis or disruption. But there's quite a gap once the microbiome itself is developed, approaching adolescence and then that hyper growth period and maturity phase of children,” explained Raja Dhir, Co-Founder of Seed, a venture-backed microbiome company.

Last month Seed entered the children’s health market with PDS-08 Pediatric Daily Synbiotic, a clinically studied, two-in-one powdered synbiotic formulated for children and adolescents (ages 3 to 17) with 9 probiotic strains and a fiber-based prebiotic.

“I think that oftentimes data is extrapolated from adults and it’s assumed that it works in the pediatric population, but that's not always the case. And so it was important for us to have data on the population of interest here, which is ages 3 through 17. So you find the data on the strain, you'll also find that in the age of the children that were recruited in our randomized controlled trial as well,” said Dhir.

PDS-08 is backed by 18 clinical studies validating strain-specific benefits across gut barrier integrity, gut-immune function, dermatological health and respiratory health. It was also evaluated in a 12-week, randomized, placebo-controlled clinical trial demonstrating support for gastrointestinal function and healthy regularity in a pediatric population. The trial analysis employed bioinformatics from the Mason Lab, which specializes in next-generation sequencing, functional genomics, and algorithms to elucidate human disease mechanisms.

Gaining traction

“The demand for infant/child probiotics is quite strong. We leaned into this interest when we acquired the TruBiotics brand from Bayer Healthcare in 2021. At the time, TruBiotics was available as an adult only product. We innovated quickly to expand the TruBiotics product line for infants and children through baby drops, sugar-free chewables and sugar-free probiotic gummies,” noted Pam Cebulski, general manager consumer brands, SVP marketing, PanTheryx.

The new TruBiotics Baby Drops feature the clinically researched probiotic strain BB-12 to address several challenges, including increased crying and fussiness.

A 2021 clinical study, published in the journal Beneficial Microbes, included 192 breastfed infants with colic that were 12 weeks of age or younger. For 21 days, the infants were given a liquid suspension 1 billion CFU per day of BB-12 or a placebo. The infants who received the BB-12 probiotic strain had 50% fewer crying episodes, a 56% reduction in crying time per day, and an hour more of sleep per day. Parents also had significantly higher quality of life scores related to socio-emotional and physical functioning.

“For our TruBiotics line of probiotics, which spans infants to adults, we identified gold standard clinical research specific to the age and health benefits–including digestive and immune health–we wanted to capture in each product, and then formulated finished products to meet consumers’ needs. Additionally, the gut microbiome early in life is quite different than in adulthood and supplementation with the appropriate types of probiotics are key. For example, beneficial Bifidobacterium are early colonizers in children’s intestines, whereas beneficial Lactobacillus become more predominant in late childhood through adulthood,” explained Cebulski.

Benefits sought

Dhir told NutraIngredients-USA that childhood constipation, a lack of regularity of bowel movement and stool inconsistency are the most common issues reported by parents. Another popular complaint is atopic conditions in children, such as eczema and psoriatic skin presentations.

Another health concern that continues to be on trend is immune and respiratory health.

“Immune health is one of the most significant health concerns parents are trying to tackle with a probiotic for their children. There’s a variety of reasons why infant and children’s immune health might need support. Often, a child has limited exposure to beneficial microbes, which help balance the exposure to an overabundance of diverse disease-causing microbes. Allowing a child to get a little dirty outside and allowing them to be around animals have shown to have a positive effect on the developing immune system,” said Cebulski. “Children who are in daycare have immune systems that are constantly being challenged. Studies show that these children suffer from an increase in respiratory infections and gastrointestinal illnesses much more than children who stay at home.”

Consumer engagement

When we look at the data, what’s the most engaging benefit on average? “Inner ear, nose & throat support, driven by Hyperbiotics Pro-Kids ENT with over 5k reviews. It contains K12, M-18 from Stratum Nutrition. The same product is also positioned for Respiratory,” noted Ewa Hudson, Director of Insights, Lumina Intelligence. “Constipation is another key direction, with LGG, Protectis and LactoSpore. Culturelle’s Kids Regularity received over 10k reviews, with a very high consumer satisfaction rate expressed with a star rating of 4.68 out of 5.”

Lumina tracks 64 products for children and infants, produced by 30 companies.

Zoom out

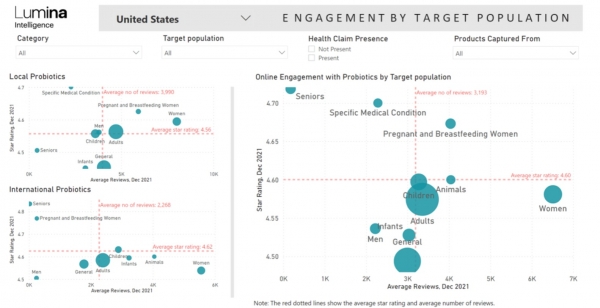

Hudson said that looking at the big picture, there was strong growth in consumer engagement in the US online in 2021 with 151% (driven by the first half of the year), after a phenomenal growth of 320% in 2020.

But on the other hand, if we compare the US with the global picture, probiotics for infants and children are in the back seat. She added that products for pregnant and breastfeeding women are perhaps driving the pediatrics offering, although many focus on women’s health rather than prenatal.

Interestingly, animals did better than infants and children. Animal probiotics had about 4k reviews, while infants and children had around 3k. “The opportunity in animal probiotics is another thing that is definitely on the rise, driven by the new pet ownership that spiked during the lockdowns. We see searches for probiotics for dog’s diarrhea and cat’s constipation rising on search engines such as Google,” observed Hudson.

Zoom in

Zooming in on children and infants, Hudson said there was a lot of growth in the first half of 2021, and only 9% in the second half of the year.

“The second half of 2022 was quite challenging for many products. On one hand, we had a strong growth in the first half of the year, with the online reviews for probiotic supplements up by 108% in the USA, which suggests many new customers coming to the scene. Maintaining new consumers is always challenging. On the other hand, shortages of ingredients and impact on product availability increased towards the end of 2021 and into 2022. As such we found a group of products doing very well in the second half of the year, and others suffering in the short term. Overall, the engagement around children’s probiotics was stronger than in the case of infant products, likely driven by greater exposure of children to mixing with others in school and playgrounds. Some of the fastest growing products included Garden of Life Primal Defense Kids, with reviews up by 83% in the second half of 2022, American Health Probiotic Kid Chewables (77%) and Vitables Chewable Multi-Vitamins with Probiotics & Enzymes for Children (52%).”

Up-and-coming benefits

Hudson noted three up-and-coming benefits to be on the lookout for in the future are gut-brain, skin and bone health for children.

Join us for Probiota Americas

Hudson, who has spent 20+ years tracking health and wellness, microbiome and e-commerce trends, will be speaking at the IPA World Congress + Probiota Americas , the leading annual event for the prebiotic, probiotic and the microbiota on June 1-3, 2022 in Washington DC.

For more information and to register, click here.