Lumina: More and better reviews key to online success

Tom Morgan, senior market analysts at Lumina, presented the service’s latest data on online engagement to attendees of the recent Sports Nutrition Summit 2020 put on by NutraIngredients-USA in San Diego. Both NutraIngredients-USA and Lumina are part of William Reed Business Media.

Capturing insights about what consumers are saying

Lumina has a business model of capturing what consumers are saying about products online as a way to measure their actual sentiment about the products. Hard sales data gets at the same information in a cruder way—if few people buy a product it’s a good sign that they don’t like it. But Lumina’s approach can help companies find that information quicker, potentially in time to do something about it before the bad quarterly sales numbers come in.

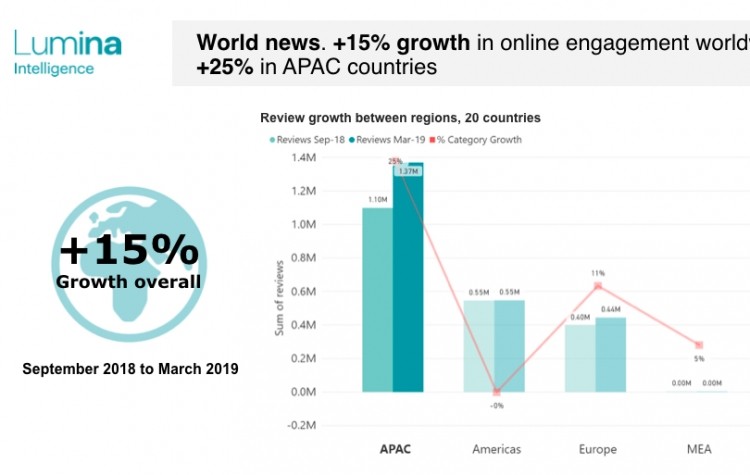

Morgan noted that the tide of online reviews has grown worldwide, and most quickly in fast growing markets. From September of 2018 to March of 2019 the total number of reviews for all nutrition products in the 20 countries that Lumina measures grew by 25% in the Asia Pacific region and by 11% in Europe. Reviews were up slightly in the Middle East and were flat in the Americas, which is still the largest market for sports nutrition products.

Lumina Intelligence

Lumina Intelligence

For more information on purchasing Lumina Intelligence reports click here.

But the online presence in the social media landscape for sports nutrition products in particular has shown a slight decline in recent months. The total number of unique authors posting mentions of fitness supplements on Instagram declined from more than 13,000 in early 2018 to a bit less than 10,000 today.

Shifting consumer priorities

Morgan said part of this could be a shift in consumer perceptions about what’s important. Body acceptance seems to be a rising tide, while the search for ways to modify an unsatisfying physique are on the wane. For example, using Google Trends data, searches for how to get six pack abs have declined precipitously from 2015 to the present. Among terms used in social media posts about fitness products, “time” and “health” stand out while terms such as “training” and “strength” are on the wane.

Fewer reviews = less success

So it begs the question of whether the traditional sports nutrition approach that appeals first to dedicated strength athletes is still connecting to the market as well as it might. While it remains to be seen how the landscape of consumer desires will change, Morgan said one thing that is not in question is how to win online. If people aren’t taking about and sharing about your product, you’re in trouble.

“Sixty-two percent of online buyers refer to reviews before making a decision,” Morgan said.

The number of reviews can be used in a predictive fashion to see which product categories are most at risk, he said.

“Product categories with the lowest reviews have the most chance of being dropped,” he said.

China opportunity

While the US is still the largest market for sports nutrition products, China offers the biggest opportunity for long term growth, Morgan said. The effects of the 2008 melamine scandal are still being felt, and ‘Made in USA’ products are still enjoying a halo of quality and safety vis a vis their Chinese counterparts.

More than half of all of the best selling sports nutrition products sold in China were made in the US, Morgan said. Less than a quarter were made in China, and the rest came from Europe and Canada.

SNS21

Sports Nutrition Summit 2021

To receive the latest updates on the next installment of the Sports Nutrition Summit series, register here.

And US products dominate in the number of product reviews within the country as well, he said. From September 2018 to March 2019 the number of reviews for US made products grew by more than 34%. Reviews of Chinese made products grew by only 5.6% in the same time frame.

In closing, Morgan said Lumina data could be used by companies to tailor their social media strategy. To be most effective, messaging needs to be directed at what consumers who are active on specific platforms find important and interesting. What works on Instagram might not fly on WeChat, for example. With a targeted strategy companies have the best chance for moving consumers to the highest margin platforms, which is usually the company’s own website, he said.