Exploring the underdeveloped category of probiotics for seniors

The report provides a top line e-commerce landscape overview of probiotics for seniors through a range of strategic fact sheets, all highlighting the gaping hole in this under-served market segment.

Key findings

On a global scale, Life-Space dominates in probiotics for seniors with 27,000 reviews. Life-Space Probiotic for 60+ Years is the most reviewed globally probiotic product for seniors.

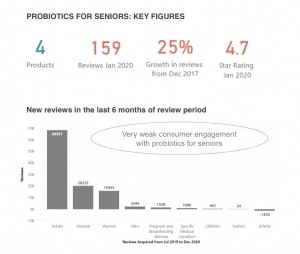

Only four products were found in the American e-commerce landscape at the time of research (January 2020). Hyperbiotics is a clear leader with 141 reviews, followed by CVS Health.

Probiotics with a daily dose of 3 billion CFU are the most reviewed in the United states and Canada.

Overall, reviews for senior probiotics increased over 700% in two years, with an average 4.6/5 stars. The report points out that the average probiotic for seniors “attracts 20% more reviews than a very well established probiotic aimed at the general population, highlighting market opportunity.”

To understand why probiotic brands are overlooking such a lucrative opportunity, NutraIngredients-USA spoke with several industry veterans about this neglected demographic.

Access

“One challenge for seniors is distribution. Given that many seniors are shielded right now, their access to stores to buy probiotic supplements is restricted. At the same time, most are not that savvy enough to use e-commerce,” explained Joshua Schall of J. Schall Consulting.

Schall, a CPG strategist, said in order to facilitate better access to probiotics, “brand manufacturers and retailers need to adjust their content strategy into a trusted source of information to solve the problem. Retailers like Walmart have done an exceptionally good job at explaining how to order groceries online. While seniors might not be used to shopping for groceries online, the same could be said for the entirety of America. But, the fact that the largest retailer in the world is taking the time to educate and do what it can to make the safer shopping experience of online grocery a habit is a business lesson in how to morally operate during a crisis.”

Education

Indeed, Dr. Mark JS Miller, president of Kaiviti Consulting, said the reason seniors remain an underdeveloped sector is because they have stopped acquiring new relevant information. “Most equate probiotics and gut flora to GI motility issues, especially constipation, and they are used to managing this with fiber products, not probiotics. I think there is a disconnect to the importance of a healthy microbiome with systemic health needs and concerns, so probiotics are not in their mindset for how and why they should use them. I think that educational message is the portal to getting their interest.”

George Paraskevakos, executive director of the International Probiotics Association, agrees that education is key, adding that the science is out there, many just aren’t aware. “Although there is great science when it comes to probiotics, it comes back to some education that is needed to underline this newly evolving science.”

However, Paraskevakos said don’t look to doctors to fill that education gap: “Older generations like to have their doctors recommend products and in my view, there is an education gap with health care professionals for probiotics leading to doctors hesitating to talk about probiotics to their patients.”

This is confounding, given probiotics' history of safety. In fact, a recent global analysis of clinical trials with probiotics show that over 1,600 human clinical trials have been published on probiotics in ClinicalTrials.gov and the International Clinical Trials Registry Platform of WHO databases.

“There’s a ton of science that continues to evolve, but everything we’ve seen points to positive health outcomes. There are no documented adverse events and probiotics are one of the safest supplements on the market,” explained Paraskevakos, whose nonprofit organization has been the collective voice for the probiotics industry since 2001.

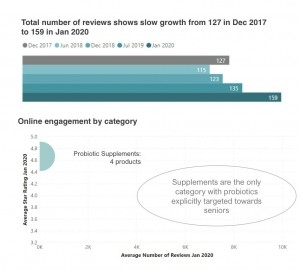

Delivery systems: Supplements dominate

According to the Lumina report, supplements are the only category with probiotics explicitly targeted towards seniors.

Paraskevakos said when it comes to taking probiotics, the deciding factor boils down to format. “Some challenges faced are for sure proper formulations directly targeting the older (boomer or the silent generations). Delivery systems are a big one when it comes to compliance – having the right vehicle to ensure that seniors take their probiotics is important.”

Schall said marketers should direct labeling toward benefits related to age — not age alone. “Today’s overabundance of products in every functional CPG category creates a difficulty for any consumer to find the right option for their individualized needs. Seniors have specific goal-orientated needs and wants that likely differs from the median or mode consumer group. Those callouts on the packaging could be related to formulation or delivery method.”

Gummy vitamins have notably gained popularity over the last decade. However, George Kokkinis, co-founder and managing director at Pharmako Biotechnologies, said that while they work for multivitamins, gummies present several limitations for probiotics. For instance, gummies rely on water soluble ingredients and use high temperatures during the manufacturing process. That being said, most active ingredients in probiotics are not water soluble and are also temperature sensitive.

“Various active ingredients, simply because of their lipophilic nature and inability to mix with water, do not lend themselves to user friendly and novel dosage formats (such as, oral powders, powders for drinks, drinks, chocolate, yogurts, gummies, effervescent tablets/drinks, etc). Considering that most formulations in the marketplace are tablets and capsules, it lends us to believe that the supplement companies are grappling with these concepts and have not really understood them,” explained Kokkinis.

Kokkinis added that the key is to make a dosage format that is easy to take, make, has increased absorption and can carry a multitude of different types of active ingredients. “Technologies, such as micelles, liposomes and lipid hybrids can transform many difficult active ingredients into performing like water soluble actives, while, at the same time, increasing their absorption. These abilities now open up a multitude of delivery formats for most active ingredients that were not previously achievable. Also, increased absorption gives rise to smaller doses and more efficacious formulations. Pharmako’s AquaCelle and LipiSperse award winning delivery systems are good examples of these technologies. Popular ingredients like resveratrol, astaxanthin, curcumin, palmitoylethanolamide, quercetin, lutein, etc can all be transformed into water soluble/dispersible, absorbable actives.”

Seniors are complicated

“The senior population certainly suffers from “pill fatigue” and as such they are reluctant to add to that pile,” explained Miller.

Indeed, Kokkinis said seniors present unique challenges because most take several prescriptions. “Medications in the elderly are more complex because of the physiological changes associated with aging and the increased burden of disease. At any given time, it is not uncommon for the elderly to be taking over 10 medications and when this is compounded with the addition of dietary supplements (which are inherently larger in size and frequency), pill burden becomes overwhelming. The result is that, these complex regimes lead to confusion and sometimes a lack of certainty in their effectiveness and generally, frustration.”

Strategic roadmap

According to the Lumina report, immunity and constipation probiotics for seniors are key gaps in the market that offer major opportunities.

Miller agrees, noting that when it comes to which health benefits are of most interest to seniors,“Historically, it is constipation, which they manage with fiber products. But they remain unaware of the actions outside the gut, and do not know of the synergistic actions on the microbiome of combining pre- and probiotics. Most would not know what the difference is.”

So how do brands lure in seniors, many of which already have enough capsules in their pillbox?

“Immunity may be an important connection given the trials and tribulations of 2020,” Miller pointed out. “Maybe if we stress the role of a healthy microbiome we can emphasize its role in optimized immunity will catch the attention of seniors at risk for COVID-19 and other infections like influenza and pneumonia that play havoc with seniors.”

“With few products on the market, there is a big gap in probiotics for seniors, especially in light of the coronavirus disproportionately affecting senior populations,and its links to immunity, inflammation and obesity,” noted the report.

Lumina Intelligence is an insights service provided by William Reed, the publisher of Nutraingredients-USA. Lumina tracks products and online consumer reviews across 25 countries to provide insight into nutrition markets.