Consumers have zeroed in on nutrition since the pandemic onset

Packaging company TricorBraun has found that over a third of US nutritional consumers―defined as those taking vitamins, minerals and/or supplements—are taking more now than they did before Covid.

The TricorBraun "Nutritional Purchasing Since COVID-19" Survey polled more than 1,600 purchasers of vitamins, minerals and/or supplements in the US since the onset of the COVID-19 pandemic and over 800 nutritional purchasers in Canada. The company said the survey was conducted to gain a deeper understanding of the impact of the pandemic on nutritional consumers' buying behaviors and trends, as well as their packaging preferences.

"COVID has intensified consumers' focus on their health, and as a result, consumption is up," said Becky Donner, senior vice president, Marketing, Design & Engineering at TricorBraun. "Behavior shifts due to COVID indicate that consumers are unwilling to take health risks, which means it's likely we'll continue to see increased consumption of vitamins, minerals, and supplements as a preventive measure.”

US consumers

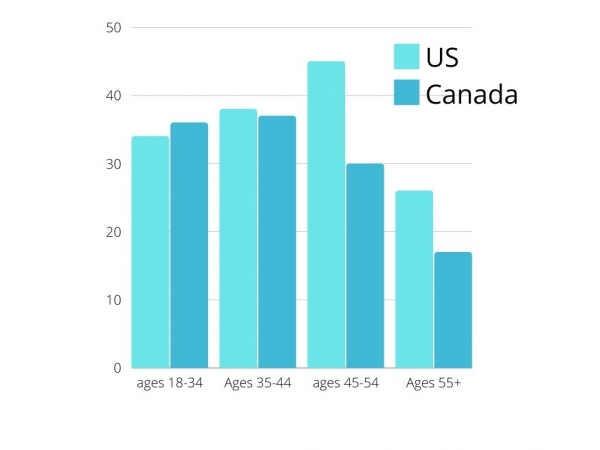

Among US nutritional consumers, 45% ages 45-54 are taking nutritional products more since Covid, while 39% of those ages 35-44 are as well, along with 34% of those ages 18-34. Among US nutritional consumers ages 55 and up, 26% say they take more vitamins, minerals, and/or supplements since COVID-19.

Canada

Among Canadian nutritional consumers, 37% of adults ages 35-44 are taking nutritional products more often since Covid, while 36% of those ages 18-34 are too. About 30% of consumers ages 45-54 say they take much more or somewhat more vitamins, minerals, and/or supplements, with 17% of those aged 55+ say they are as well.

Why consumers are purchasing more nutritional products

Among US consumers who purchased vitamins, minerals and/or supplements since the onset of COVID-19, top reasons for doing so include to support immunity (52%), to balance daily nutrition (48%), and to prevent new health conditions/illness (32%). Results are similar among Canadian purchasers: to support immunity (55%), to balance daily nutrition (43%) and to prevent new health conditions/illness (32%).

Gender

Among those US consumers who purchased nutritional products since the Coronavirus outbreak, women are more likely than men to say they have purchased vitamins, minerals, and/or supplements to support immunity (58% vs. 46%) and bone health (31% vs 25%). However, men are more likely than women to have purchased vitamins, minerals, and/or supplements to improve memory (20% vs.12%) and for sports nutrition (17% vs. 6%).

Among Canadian consumers, women are more likely than men to say they have purchased vitamins, minerals, and/or supplements to support immunity (60% vs. 50%) and bone health (38% vs. 23%). Men are more than three times as likely as women to have purchased vitamins, minerals, and/or supplements for sports nutrition (15% vs. 4%).

Online vs in-store

The inevitable surge in e-commerce during lockdown has had a major influence on consumer shopping habits, with 36% of US consumers reporting that they changed where they primarily purchase vitamins, minerals, and/or supplements. The survey found that 25% of respondents say they mostly shopped in-store for dietary supplements before the pandemic, but now primarily shop online, and 11% say they primarily shopped online before and now primarily shop in-store.

In Canada, 25% of those who purchased nutritional products before Covid say they changed where they primarily purchase dietary supplements, with 18% saying they mostly shopped in-store pre-pandemic but now primarily shop online, and 7% reported they primarily shopped online before and now primarily shop in-store.

Sustainability

For nearly 70% of US nutritional consumers, sustainable packaging is neither more nor less important, less important, or was never important to them since the pandemic onset; this is also true for 74% of Canadian consumers. Additionally, 30% of US consumers and 25% of Canadians report that sustainable packaging is more important to them since the onset of the pandemic.

"When Covid hit, sustainable packaging took a back seat to safety," observed Donner. "As consumers' reliance on ecommerce and delivery continues, however, they are very conscious of their purchasing impacts on the environment, and we see that awareness growing among nutritional consumers. Sustainable packaging is re-emerging as a need versus a nice-to-have."

Sustainability not as important for 55+ crowd

According to the survey, 35% of US consumers ages 18-54 and 20% of those 55+ say sustainable packaging is more important to them when purchasing dietary supplements. The survey shows similar results in Canada, with 34% of those ages 18-34 and 20% of those 45+ reporting that sustainable packaging is more important to them when buying dietary supplements since COVID-19.

Packaging matters

In-store packaging strategy strategy is a huge part of appealing to customers and ultimately a way for retailers to maximize sales.

On the other hand, packaging also needs to protect the product from manufacturing all the way to the consumer’s door. Donner said brands have to have a strong ecommerce packaging strategy on top of their Visual merchandising strategy.

"The pandemic changed how many consumers shop, and that impacts how consumer packaged goods and nutritional manufacturers should consider packaging their products. An ecommerce packaging strategy, in addition to an in-store packaging strategy, is critical. Simply repurposing packaging from the shelf for ecommerce presents several risks, including the high potential for shipping damaged product, resulting in a negative consumer experience,” said Donner. “As the category continues to grow, it's more important than ever that nutritional brands stand out, including through packaging design that is also ecommerce-friendly."