Promotional Features

Beauty-from-within and beyond: Exploring the modern consumer through the lens of clinical research.

Market overview/introduction

In recent years there has been a significant increase in the development of the ‘ingestible beauty’ trend, however, a more common and ‘consumer friendly’ term has taken precedence. ‘Beauty-from-within' speaks to the modern consumer and has grown in popularity. Clinical research has shown that beauty is not skin deep, it is integrated approach including both skincare and a healthy diet

The surge of consumers focusing on self-care amid the pandemic has only accelerated the emergence of wellness as a holistic trend extending to traditional beauty areas such as skincare. Including clinically proven botanical ingredients and using the highest standard of practice (ICH-GCP) will significantly increase the success of a product, which will be further addressed in the latter of this article.

Furthermore, like many other categories, the pandemic has accelerated the beauty industry’s shift to e-commerce as brick-and-mortar locations have had to close. In the US, personal care and beauty online sales totaled an astonishing $62.6B last year, up from $53.1B in 2019, per CB Insights.

Market growth and the future of skin

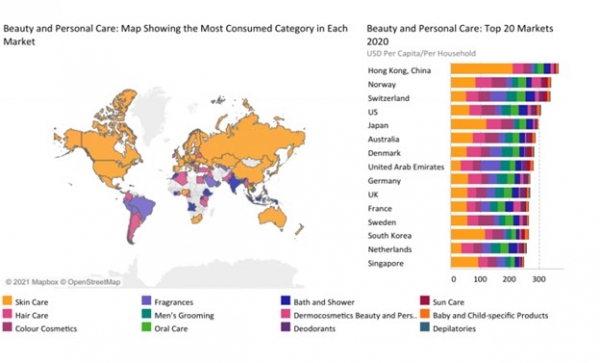

The global beauty and personal care industry was worth a staggering $487.4B in 2020, of this the skincare industry was worth $139.6B. Skin care’s 2021 growth is predicted to outpace all other categories, driven by Asia-Pacific, in particular. The post COVID-19 era will result in a direction of sustainability focused and digitally savvy brands, as well as those that offer affordable, clinically validated and wellness orientated solutions. While projections for growth vary, most agree it will continue to advance at a 5%-to-7% compound-annual-growth-rate to reach or exceed $800B by 2025.

(Source: Passport: World Market for Beauty and Personal Care, 2021)

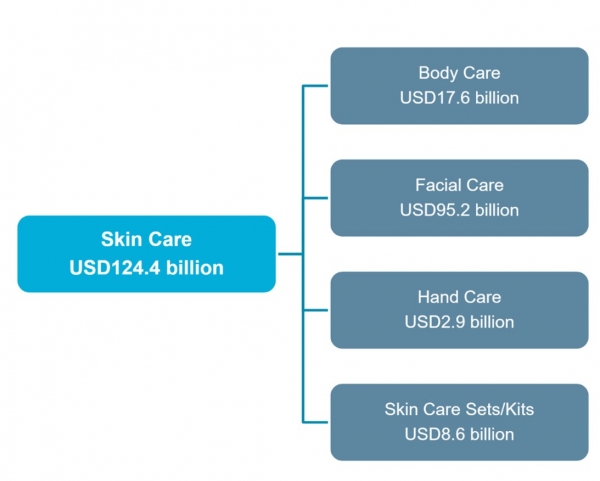

Skin care industry, at a glance

(Source: Euromonitor)

Wellness versus symptomatic

A report from Lumina Intelligence identified two segments of consumers depending on the application reason: wellness versus symptomatic. For example, in eczema, the leading sub-area is psoriasis with 2,000 average monthly searches. At the keyword level of this sub-group, searches for the term “best probiotic brand for psoriasis” have shrunk by nearly 80% in the last 24 months. However, “best probiotics strain for psoriasis” is growing exponentially (1,300%). Is this a shift in the way consumers are seeking out recommendations? And does this open a gap for suppliers to influence the end user with content on their strains?

In acne, “hormonal” and “fungal” acne appear in high-growth niche quadrant. Despite acne as a whole group having low growth in comparison to others, there are still high-growth opportunities worth exploring. These “cause” searches are not necessarily people taking probiotics to alleviate acne, but it tells us that these symptom consumers are wary of the impact of any dietary changes. Therefore, they might need more convincing probiotic efficacy – no matter what they are taking them for.

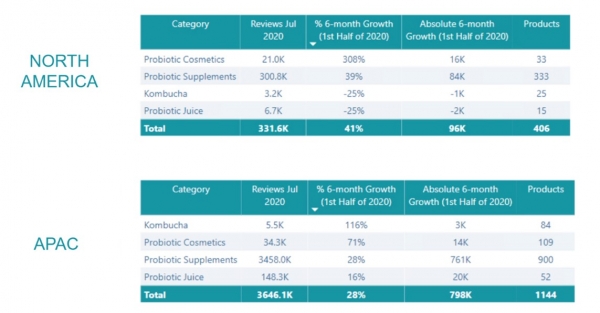

The report from Lumina also highlighted that cosmetic products with probiotics saw the largest growth in consumer interest of 113% in the first half of 2020. Consumer online engagement with probiotic cosmetics grew 8 times faster in percentage terms than that with probiotics supplements in North America and 2.5 times faster in Asia-Pacific.

(Source: Lumina Intelligence: Skinbiotics: Probiotics for skin health, eczema, allergies & more, 2021)

Clinical research trends

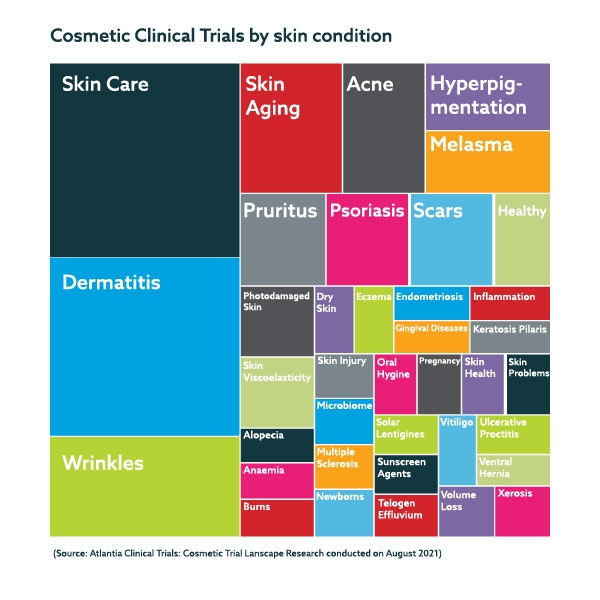

To fully understand the cosmetic market of products whose claims have been scientifically validated, the Atlantia team looked at Clinicaltrials.gov and downloaded all trials under the keyword “cosmetics” on 26/08/2021. Just trials carried out with cosmetic products, dietary supplements, probiotics, and combinational products were included (n=89). Clinical trials tackling the skin with biological, medical devices, drugs and chirurgical interventions were excluded.

The variables used to segment the data were study type (interventional/observational), condition researched and product type of the intervention if any (dietary supplement, cosmetic product, combinational product).

By study type, 78.65% of studies carried an intervention while 21.35% were merely observational.

Interestingly, there was a considerable variation on average sample sizes on intervention studies (89 participants) versus observational studies (2607 participants). This makes sense as there are different formulas of sample size calculation for different types of variables measured in distinct study designs, namely descriptive, epidemiological, comparative, and interventional research studies.1 (Kumar 2020)

By condition researched, many diverse conditions were recurrent as study endpoints:

The conditions were categorised following Lumina Intelligence’s market categorization of wellness versus symptomatic applications. Wellness aimed conditions, such as skin wrinkles or skincare represented 51% of the total. Symptomatic applications such as atopic dermatitis represented 49% of the total of published studies.

“Given skin’s sensitivity (and visibility), many consumers are particularly cautious about the ingredients, quality and brand of the skincare products they buy. Previous personal experience is the top influencing factor for any skincare product purchase. Products with demonstrated efficacy will garner more purchases and recommendations than advertisements, loyalty rewards or discounts. Claims about functional benefits work best when they are able to connect with consumers’ individual concerns about their skincare needs.” Euromonitor (2018)

Euromonitor’s report mentioned that advances in microbiome research are positioning probiotics as attractive and effective ingredients that are proven to both repair existing damage and boost the skin’s natural defences to resist future damage. The stronger and more widespread the scientific backing for these claims, the more products will be able to cite specific cases and add quantitative data to support existing claims. In an era of ever-increasing competition for “skin health,” using scientific studies to back up specific health claims will be key in solidifying probiotics’ hold on the premium skin care segment. If doctors, dermatologists, and other healthcare professionals can cite studies or award specific claims data to products that meet certain criteria for delivering results, then that will go a long way towards making probiotics more attractive to new consumers. In 2017, 19% of global consumers reported that their key influencer in deciding which skincare product to purchase was a doctor or medical professional, with market highs of 58% in Indonesia and 55% in Russia.

Obtaining scientifically backed claims will also help your commercial teams with the positioning of the product. In a recent report developed on microbiome search trends, Lumina Intelligence highlighted: Checking for microbiome implications will let you know the potential of your product and will help you position depending on the online trends.

As per Lumina Intelligence data, skin health related searches have increased a 60% between September 2018 and September 2020

Straight from our experts:

With Claire Tansey

Where do you see the future of skin research?

“There has been a shift away from negative ‘anti-ageing’ claims in the skin care industry and the focus is now on achieving healthy skin and ‘well ageing’ which is a more holistic approach to skin care. I believe that the future of skin research will be focused towards skin health and will delve further into the gut-skin-brain connection. Customised skincare is also a huge trend, and I will be interested to see more research studies exploring how we can look at our genetic predisposition and utilise this knowledge to take a proactive approach in targeting individual skin health and ageing concerns.”

Her Background

Claire Tansey is the Director of Operations at Atlantia Clinical Trials, which conduct clinical studies to investigate the safety and efficacy of functional ingredients, nutraceuticals, cosmeceuticals, medical foods, and dietary supplements.

Claire’s background is in the Cosmetic Industry where she has 25 years' experience across all aspects of the industry, specialising in skincare new product development, product innovation and product performance. Prior to joining Atlantia, Claire was responsible for the clinical efficacy and sensory evaluation of the Skincare and Wellness categories at Oriflame Cosmetics, conducting research studies in Europe, Asia, and Latin America.

Since joining the Atlantia team, Claire is focused on driving operational excellence across the Clinical Operations teams in Cork and Chicago, to ensure that all studies are delivered on time and within budget. Claire also contributes to the development and implementation of new business opportunities in Atlantia, to advance the quality of clinical trials and deliver on strategic ambition.