Lumina details post-COVID new normal for US online probiotics market

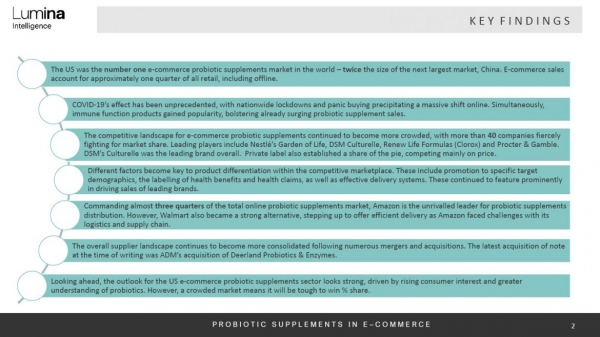

The report, which concentrates on the US market, forecasts the e-commerce probiotics channel will grow another 15% in 2021 to be worth $664 million, as more than 40 probiotic players maneuver within a cut-throat environment where the number of 5-star reviews increasingly determines brand success.

Lumina predicts ongoing strong growth for the US which in 2021 is about twice the size of the next biggest market, China.

The pandemic’s drive to digital commerce means one quarter of all US probiotic supplement sales now occur online. But there is much room to grow if the market is to match rates in the UK, China and Taiwan where 35%-60% of sales occur in e-tail channels like Amazon and TMall, and local and specialist e-tailers.

Lumina’s 64-slide US market deep dive analyses more than 40 big, small and private label probiotic players jostling for exposure and product-positive reviews that increasingly determine brand success and customer loyalty.

Drill into the world’s ‘probiotic epicentre’

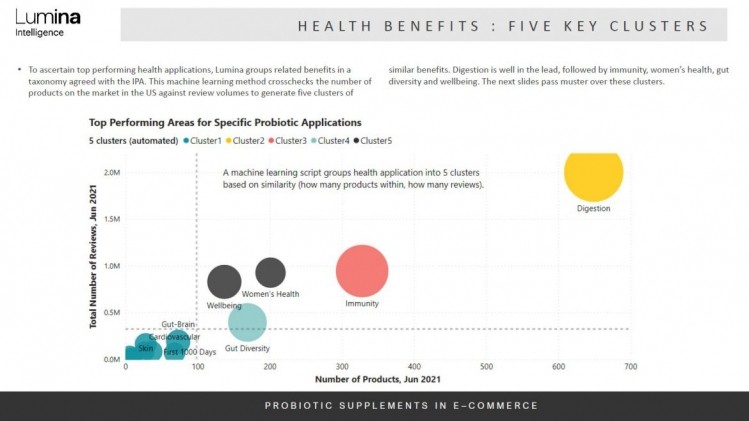

It details the most popular probiotic strains and the narrowing band of mostly major firms that supply them, the science and regulations that define and refine product marketing and formulations, demographic breakdowns (including pets) as well as COVID-influenced shifts in the e-tailer landscape.

“This report drills into the new health applications, new strains, new research, new products and M&A activity in the world’s leading online probiotics market,” said Lumina director of insights, Ewa Hudson.

“The US market lies at the epicentre of the world and is expanding in every direction, with high satisfaction ratings from online shoppers and good sales growth driven by small barriers to entry facilitated by the e-commerce giants.”

The report also describes:

- Unique COVID-19 insights from a Lumina survey conducted with key probiotic business executives.

- How smaller e-tailers like Target and Walmart as well as bespoke branded e-commerce sites are innovating to compete with the might of Amazon.

- Product differentiation and online marketing strategies in emerging and traditional health conditions of giants like DSM/Culturelle to Nestlé’s Garden of Life and the upstart disruptors like Olly and Physician’s Choice.

- How probiotic players engage with legacy and social media.

- Which strains appear in the most products and how they are rated by consumers online.

- Delivery system evolution, exposure and how they are impacting efficacy.

- The new wave of immunity-curious consumers COVID has brought into the probiotic sphere.

“There has never been a better time to check what’s happening in the market that inspires product and format trends for the global industry when strategically planning next moves,” said Hudson.

Access the report here.