Growth in China's functional gummy market expected to accelerate as regulatory environment changes: Sirio Pharma

The contract manufacturer predicted that with less stringent regulations, more functional gummies are able to penetrate the market this year.

At present, the Chinese authorities only allow basic nutrients such as vitamins and minerals to obtain a product license through the filling system, whereas gummy supplements will need to obtain license via the registration route.

One of the key differences between “blue hat” registration and filing is the processing time involved, the time needed for “blue hat” registration is longer at about three years, while product filing takes about a year.

However, Sirio Pharma is optimistic that the regulatory environment will soon favour the market entry of functional gummy via the listing system.

“As vitamin gummies might shortly be able to use the filing system – there may in fact be a major opportunity here and we would expect quick growth as the market demand is clearly there,” Rui Yang, CSO of SIRIO Pharma said.

“In parallel, we also expect to see customers working increasingly with partners that have a strong pedigree in gummy technology, regulatory approvals and product innovation to overcome these challenges,” he added.

“Though the ‘blue hat’ is still the mainstay of the nutrition and health food market in China, the general trend is towards less (product) registrations, and more (product) filings – as the latter takes less time to market.”

The firm also observed that global brands are exploring entry into China’s gummy supplements market, while domestic firms are looking to meet the rising consumer demand.

Besides gummies, probiotics and drinking formulations are some products that be in higher demand in China this year, the firm said.

"Enjoyable" dosage forms

Aside from the functions, the products need to be consumer-friendly and come in "enjoyable" dosage forms.

“Something new is always a magic key to attract the consumer and get a premium price. It could be more convenient packaging, new ingredients, special appearance, whole nature ingredients or vegetarian to support the brand’s value proposition,” Yang said.

“This is where I except to see a big concentration of industry effort – how can we improve the consumer experience. Areas like taste, appearance and texture studies are going to become increasingly the norm – especially as vitamins and nutrients are seen by consumers as more like food lifestyle choices.”

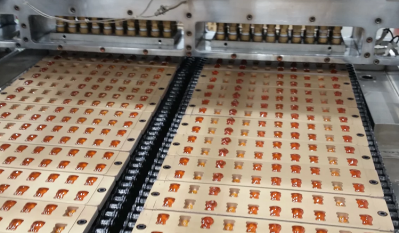

The firm previously announced a ten-year plan for its newly established production plant in Ma’anshan Anhui.

The plant will focus on producing functional gummies in the initial stages, and is expected to produce 2.4 billion gummies every year.

Demand in the US

While gummy supplements are up and coming in China, the market is entering maturation in the US.

“In the United States, we predict that the gummy segment is at the late growing stage and is entering into maturation,” Yang said.

“Therefore, as with all mature segments, we will see the private labeling market share going-up for the next few years and there will be more competition for basic products”

On the other hand, the firm pointed out that ‘low sugar’ or ‘no sugar’ products, specifically those with ‘no artificial flavors’ and ‘no sweeteners’ would be more popular in the US.

Since gummies are likely to be the dosage form, the challenges for manufacturers would be their ability to provide products with customer-friendly shapes, textures, and taste profiles.

In addition, it forecast that the vegetarian softgel market is likely to grow over the next two years.

This is because consumers are more aware of the alternatives to animal-based (gelatin) products.

With rising vegetarian and flexitarian diets, the vegetarian softgel market is likely to see sustained progress over the next three to five years.

In terms of nutrient types, single Vitamin K or combined with Vitamin D and Calcium, Vitamin B series– are seeing steady growth.

Supplements that provide eye protection are also increasingly popular across all dosage forms.