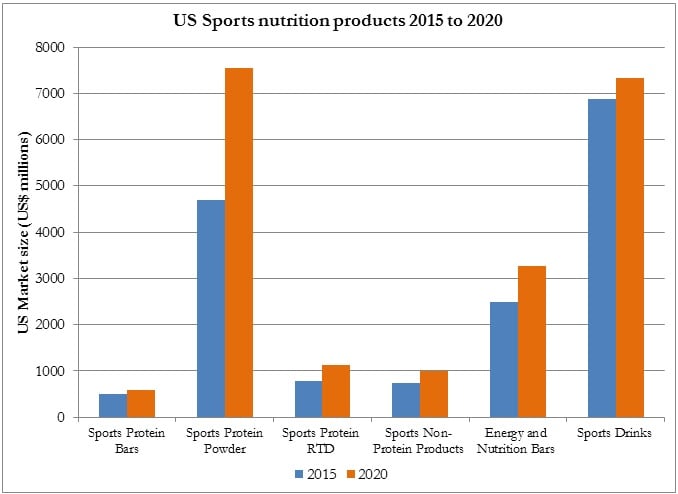

According to Euromonitor, the sports nutrition category in the US is $6.7 billion, and add in the $2.5 billion energy and nutrition bar category and the $6.9 billion sports drink category and you're looking at a current market worth $16 billion.

Sports protein powders make up 70% of that (at $4.7 billion). Sports protein RTD is the next most significant category at $785 million. These categories are expected to grow to $7.5 billion and $1.1 billion by 2020 (see figure 1 below).

“We’re still seeing huge interest in protein powders,” Chris Schmidt, consumer health analyst at Euromonitor International, told NutraIngredients-USA. “While a ton of general health, non-sports-focused brands have appeared, the sports brands are growing very strongly, as well.

“In addition to strong sales online, a number of brands have pushed into mass channels and companies like Iovate and NBTY even have stand-alone, mass facing brands (Six Star and Body Fortress, respectively) that have grown rapidly in retailers like Walmart and Walgreens/CVS in the last several years.”

READ: Whey, Soy and Pea Protein Market Trends in Sports Nutrition - Lumina Intelligence

The regimentation of fitness

Schmidt noted that, while body builders and elite athletes still make up the bulk of sales for many traditional brands, the category has benefitted greatly from growing interest among more casual exercisers.

“One of trends really pushing this is the on-going regimentation of fitness,” he added, “which is leading more Average Joes/Janes to participate in more standardized, rigorous exercise, like obstacle races, CrossFit, boot camps, etc. and opening them to supplementation (especially considering sports nutrition brands are increasingly targeting these events with sponsorships, sampling, etc. and therefore taking a bit of the category’s ‘edge’ off).”

John Gehbauer, business manager, BASF Nutrition & Health, also expects personalization to become more prominent. “Overall, growth in the sports nutrition and endurance market will continue to be fueled by consumers increasing interest in finding healthy approaches to aging, body composition, and disease prevention,” he told us. “Just as user-friendly technology is being used to track health, we can expect to see sports nutrition becoming more personalized as consumers look for supplements that work for them.

“Brand marketers may choose to tailor products for specific sports or workouts. From baby boomers, to weekend warriors to fitness enthusiasts, the market is ripe for sports nutrition products backed by credible science. Consumers are becoming savvier in their purchasing decisions and, as they scan the product labels, they'll be looking for quality and safe ingredients.”

Female sports nutrition still largely untapped

According to Euromonitor’s Trends and Developments in Sports Nutrition report, female sports nutrition represents an under-exploited area for marketers. As so-called functional fitness overtakes simple weight management techniques, more women are incorporating resistance training into their workouts, providing a big opportunity to promote the recovery benefits of protein.

Still, relatively few female-focused products vary greatly from the male-oriented versions, Euromonitor noted. And while non-protein products often have lower stimulant loads and more thermogenic and metabolism-boosting ingredients, the most distinguishing factor for many is a smaller serving size and more marketing emphasis on slimming and toning.

Sports drinks

Another significant category is sports drinks (think Gatorade and Powerade), which was valued at $6.9 billion in 2014 by Euromonitor, and expected to grow to $7.3 billion by 2019.

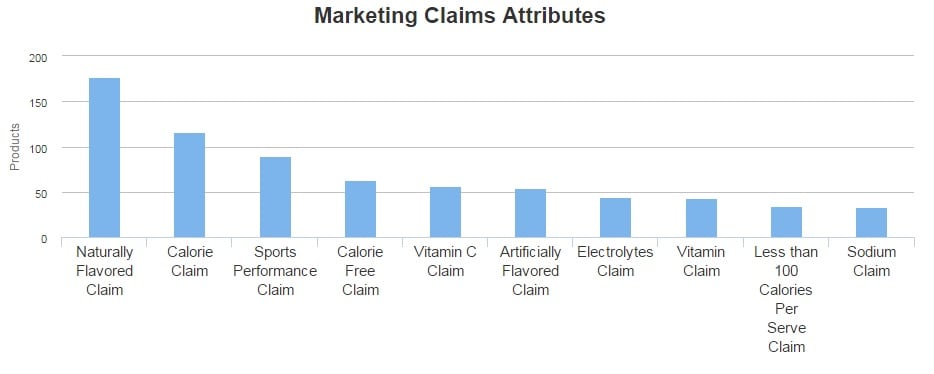

Interestingly, flavor is a major marketing tool for these products, according to data from Label Insights: For the 295 products positioned as sports drinks in its database, the most common marketing claim is natural flavored. Electrolyte and vitamin claims are less common, according to the Label Insights data (see figure 2 below).

Taste and convenience are fundamental to successful products for the wider sports nutrition category, said BASF’s Gehbauer. The company has been innovating with delivery forms and technologies for sports nutrition supplements, he said, from chewable tablets, orally disintegrating tablets (ODT), gummies, emulsions, stick packs, chewable softgel capsules, powdered drinks, as well as tablets or softgel capsules with integrated taste-masking or modified release technologies.

“Our delivery formats and technologies can be applied to almost all ingredients in dietary supplements, including vitamins and minerals, fat-soluble and water-soluble nutrients, nutraceuticals, herbal ingredients, colorants, flavors, and more,” he said.

Recovery products, marketing claims

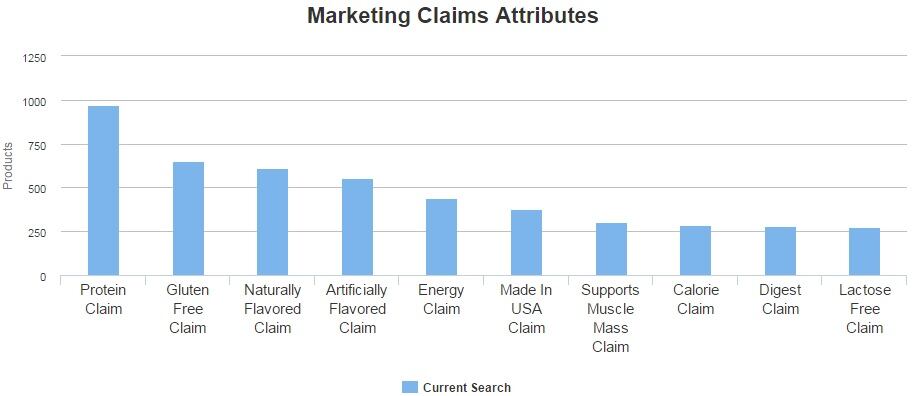

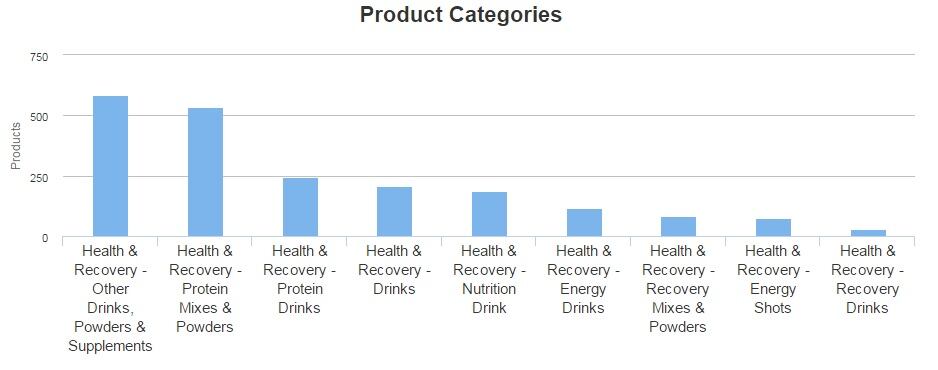

Protein also dominates the recovery category, with more data from Label Insights showing that, of the 2,056 in their database positioned for ‘energy, protein and muscle recovery drinks’, protein is the most common marketing claim, closely followed by gluten-free. Again, flavor ranks highly, but with both naturally and artificially flavored in the top 5 most common marketing claims (see figures 3 & 4 below).