The UK-based business employs 100 staff, including researchers, product developers, marketers and everyone in between, ensuring ‘vertical integration’, meaning scientific adherence and quality control.

“Last year we generated about 30% of the incremental value of the category (Euromonitor OC&C analysis), and we were the number one probiotic by value in the UK market,” Will Bowler, CEO at Symprove, told NutraIngredients.

Sales of the liquid probiotic solution have predominantly been D2C online, he explained, with an 85% female customer base, but the company has recently expanded into a number of health stores and supermarkets as it works to “follow where consumers look for gut health solutions”.

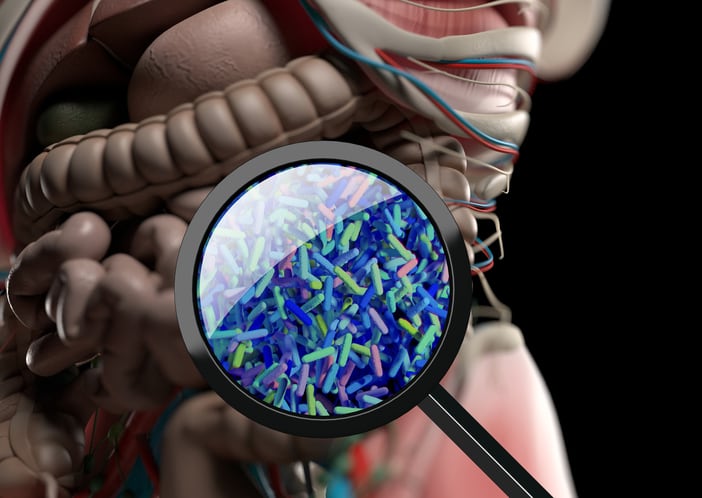

The 500 ml bottles, available in a range of flavors, contain four live bacteria strains: L. rhamnosus, E. faecium, L. plantarum and L. acidophilus. The product is designed to be taken as a shot every morning on an empty stomach.

A key barrier to entry in retail has been the product’s short shelf life—an unavoidable side effect of selling a live and active organism—but the science team has worked to extend it from four months to one year.

The GP key

The team is focused on educating general practitioners and other healthcare practitioners to be able to advise their patients on gut health and ideally recommend Symprove as a supplement.

“GPs have around five hours of education on gut health,” said Phil Thomas, the firm’s healthcare practitioner engagement director, referring to data collected by Davies&McKerr (n=432) in June 2024. “Although 77-90% of GPs think there is a role for probiotics in supporting health, 60% of GPs don’t have the confidence or understanding needed to know what to recommend.”

Bowler noted that this is a major market barrier and a critical one to overcome, as consumers often turn to their GPs for recommendations once they become aware of probiotics.

Solving the compliance conundrum

The other key barrier for growth for the probiotics market—shared with the broader supplements industry, is consumer compliance.

“I have a background in pharmaceuticals and even when the drugs are life saving there is still an issue with compliance,” said Thomas. “It’s one of those human behaviors that even when there’s a really strong reason to take something, it is very difficult to remain compliant.”

But the team is proud of its customer compliance rate, with the majority of sales coming from repeat customers and 94% of customers saying they feel the difference in 12 weeks or less, according to Bowler.

Symprove is recognized as one of the more premium products on the market, with a recommended retail price of £80 for a four-week supply. While the team has worked to bring the cost down, Bowler pointed out that a higher price point can actually support better compliance.

“There’s a commitment bias,” he said. “When you spend more money on a product, you are likely to be pretty committed to improving your health so we do understand that our customers are probably dedicated to the cause.”

The brand also provides access to dietitians in an effort to offer customers the 360 degree lifestyle guidance needed to support gut health.

The main compliance component though is the format.

“If you see it sat in your fridge every morning, you aren’t going to forget to take it,” Bowler said. “It’s much easier to integrate it into your morning routine.”

The key benefit of the format is that it allows the delivery of metabolically active bacteria, as opposed to freeze dried bacteria.

“This allows the bacteria to survive the stomach’s acidic environment and reach the gut alive and ready to support gut health,” Bowler explained.

Bacterial antagonism

Since its launch, Tte product range has changed very little aside from the addition of few additions like an on-the-go format and a new pineapple flavor launching at the end of this month.

“A lot of companies launch a lot of NPD for news and excitement but any new product we launch has to have scientific backing to show it works, and that takes time,” Bowler said.

He added that the company never relies on third party research and ensures all studies have been conducted on the finished product as opposed to the individual strains.

“Bacteria can kill other bacteria and so putting multiple probiotics into one product could potentially lead to some strains being killed,” he noted.

The brand is currently available in the UK and some parts of the Middle East with plans to start growing sales across the European market.