According to Ed Sibley, Commercial Director at Lumina Intelligence, “as the GLP-1 category scales, nutrition brands have a unique window to establish credibility and trust by aligning with the evolving needs of these consumers.”

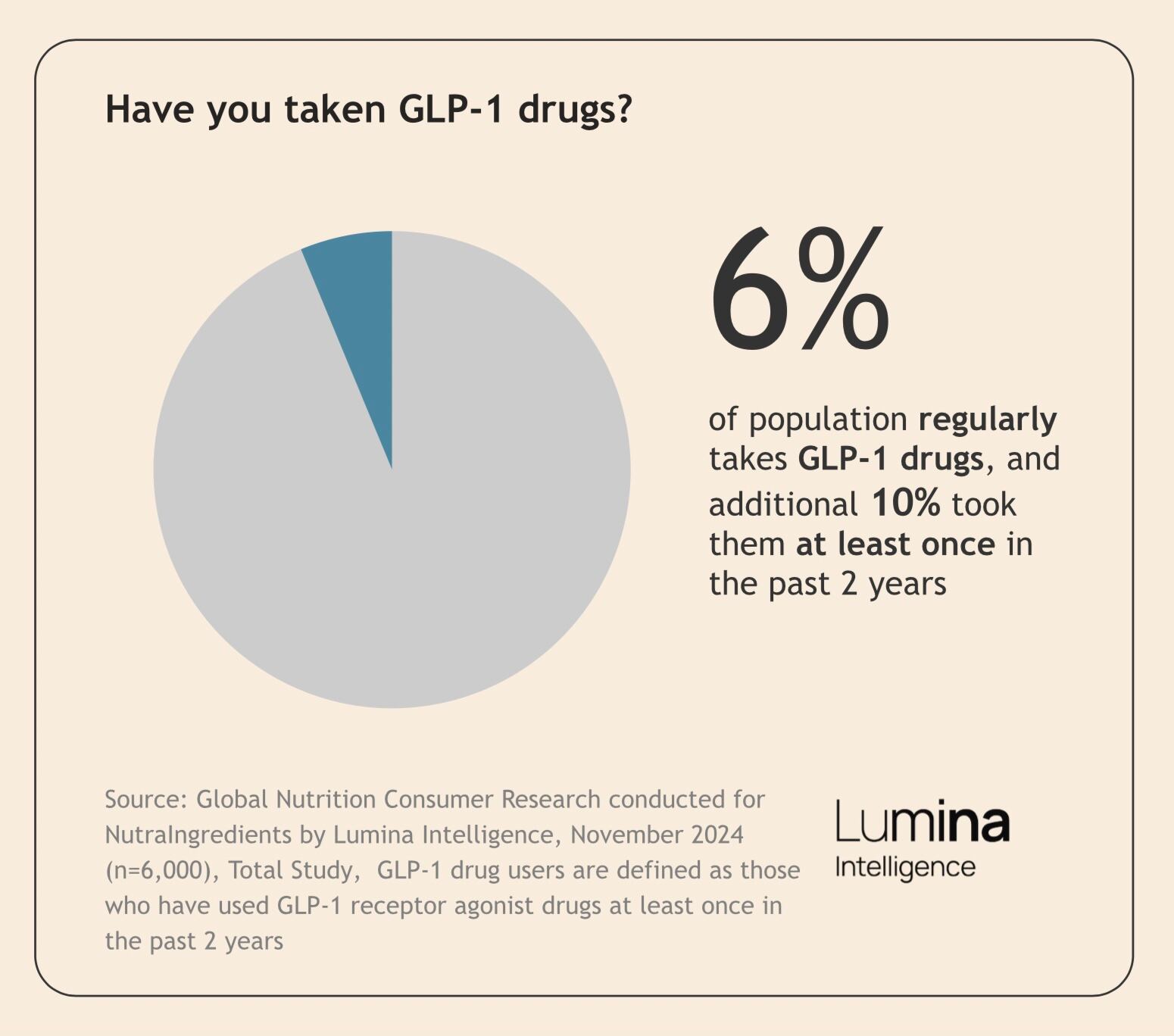

What percentage of consumers have used GLP-1 drugs?

Around 6% of the surveyed population, including participants in France, Germany, Italy, Spain, the UK, the USA, China, Japan, and South Korea, actively use GLP-1s, which creates clear opportunities for companion products.

In addition to that 6%, another 10% have taken GLP-1s at least once in the past two years. This group differs slightly; while they may still deal with lingering symptoms, their primary goal is to maintain the weight they lost.

“So their needs shift, and they’re looking for alternatives and support products to help them stay on track,” Sibley said.

“As these patterns emerge, we can now identify two distinct consumer segments - the first is current users dealing with side effects, and the second is past users focused on weight maintenance.”

For current users, side effects represent a major concern, Sibley explained, noting that “up to 50% report some kind of side effect, mostly gastrointestinal: nausea, vomiting, diarrhea, constipation, etc.”

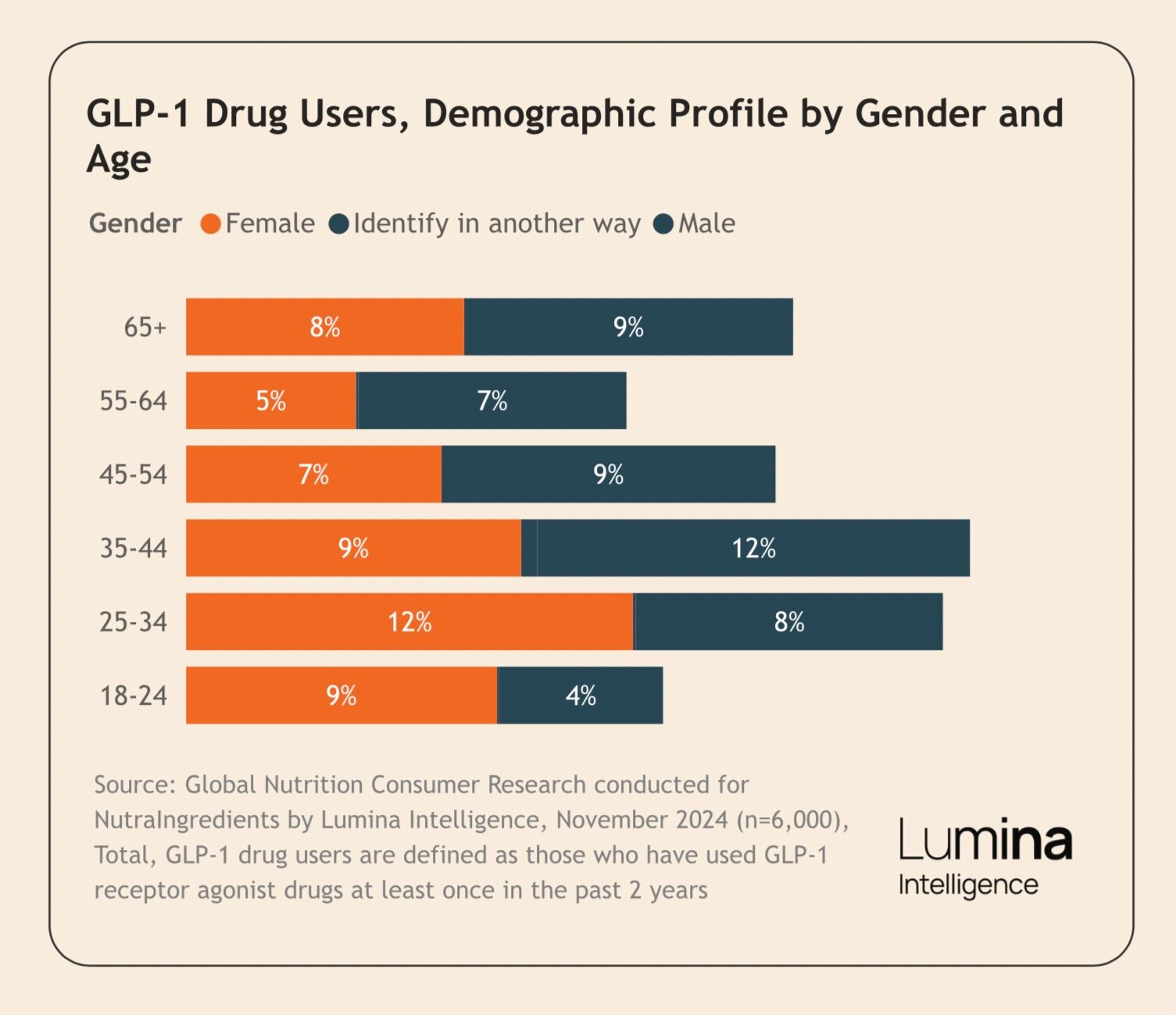

GLP-1 drug user demographics

The key GLP-1 drug users sit between the 25 and 44 age mark.

“GLP-1 drugs primarily attract users aged 25 to 34, and 35 to 44,” noted Sibley, explaining that women dominate the younger age group, while men make up the majority in the older bracket.

“This gender split likely reflects differing motivations - many younger women may respond to societal pressures and appearance ideals, whereas older men often pursue practical weight management due to limited time for exercise.”

Surprisingly, while adults aged between 55 and 64 often face greater medical need, such as postmenopausal weight gain, they remain underrepresented - possibly because they feel skeptical or lack awareness of these treatments.

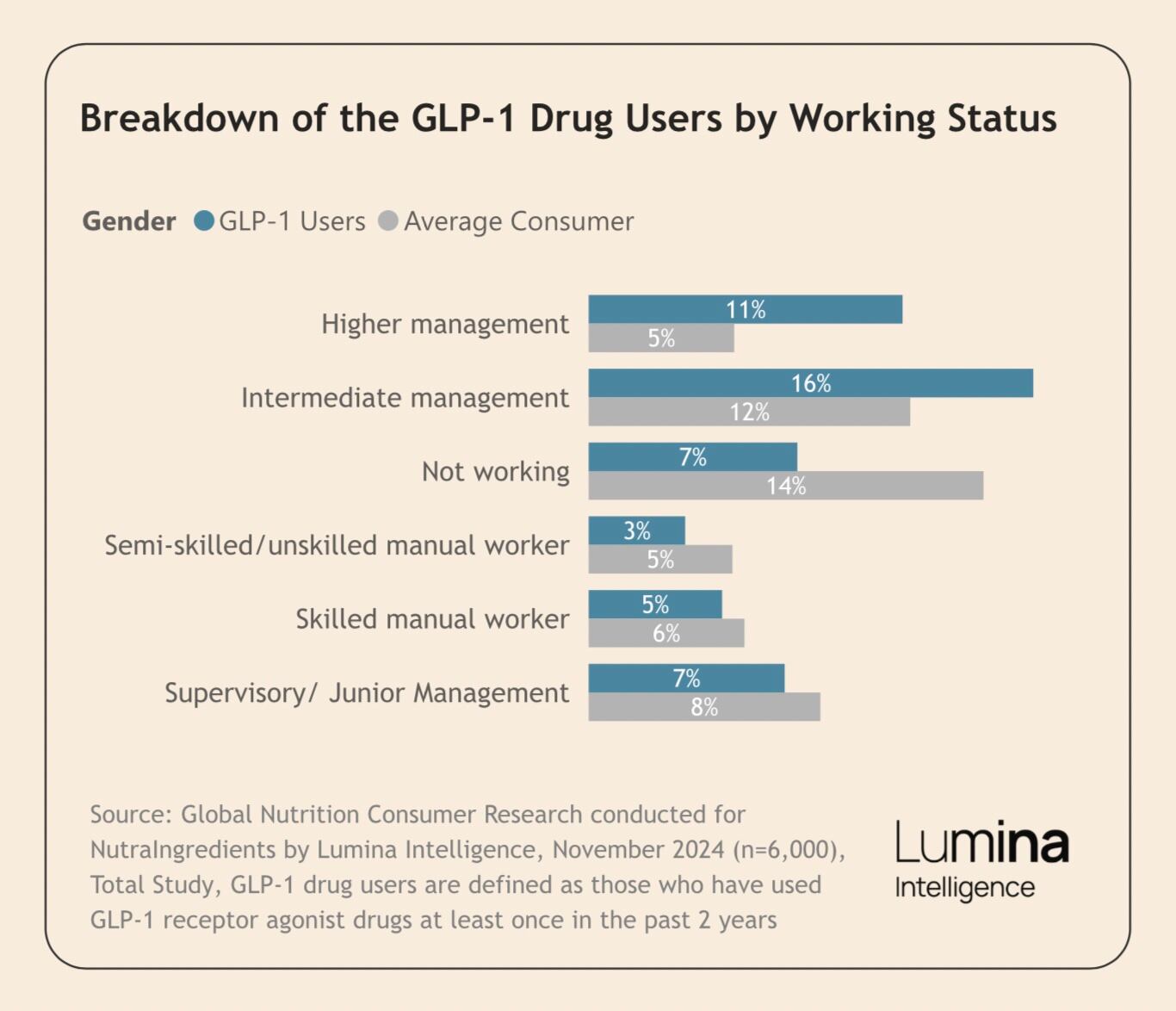

GLP-1 drug users by working status

According to the data, users generally fall into higher income brackets, with most GLP-1 users falling into the higher and intermediate management roles.

“What we’re seeing is higher uptake among more affluent consumers, however they may not necessarily be the consumers who in medical terms need it most,” said Sibley.

“People on lower incomes - perhaps who may be more affected by obesity - can’t afford these treatments.”

This is potentially creating a big opportunity for supplements that can support weight management or act as accessible alternatives, he noted.

“It doesn’t have to mimic the drug exactly, but if it’s seen as effective, there’s huge potential - especially for people looking for something less medical or more affordable.”

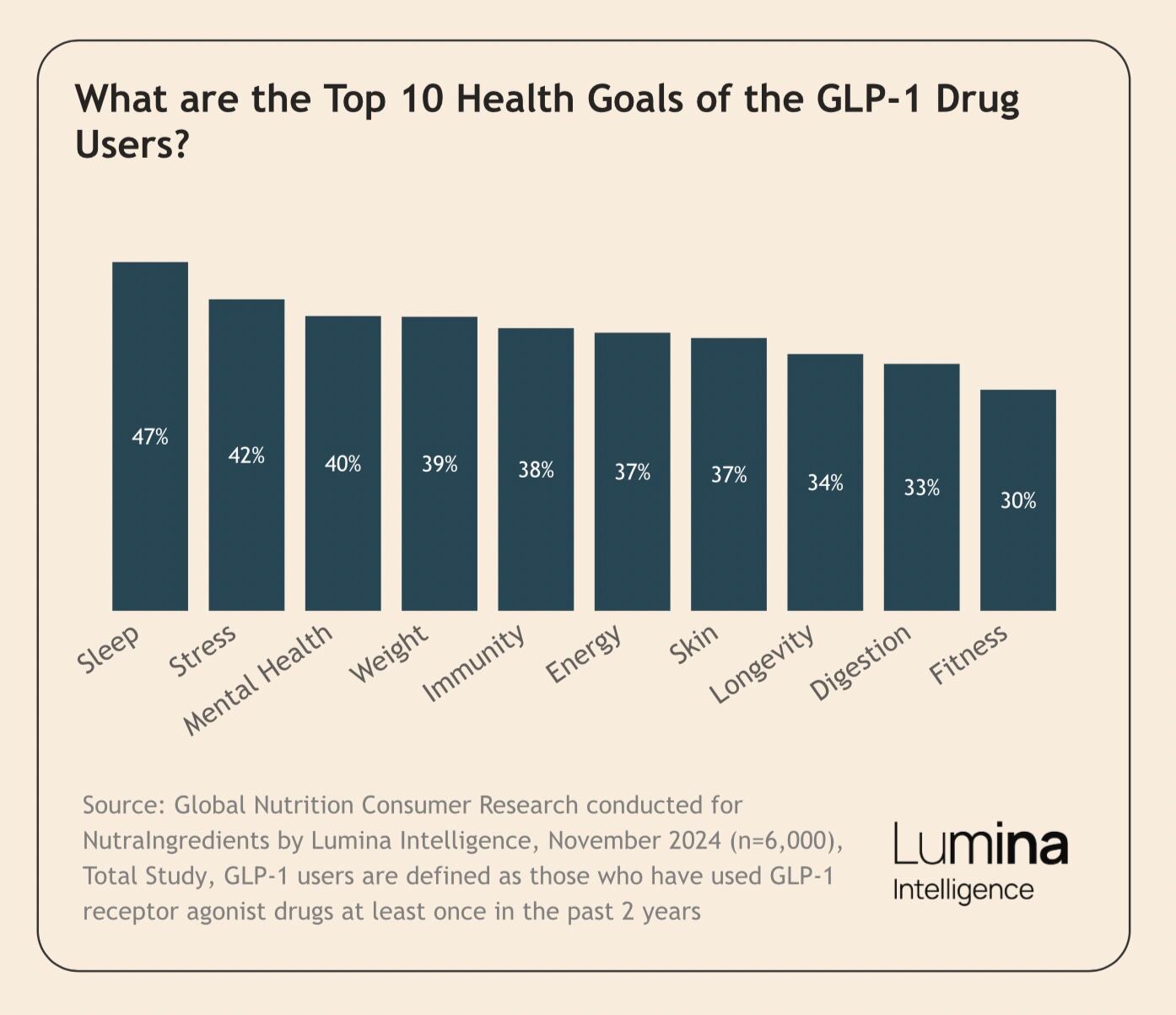

Health goals among GLP-1 users

Most GLP-1 users flag sleep as one of their key health concerns, which is consistent with broader consumer data. Stress follows closely behind, with the second largest group of GLP-1 users focusing on mental health.

While weight comes in fourth, Sibley explained that it’s often a result of deeper issues like stress and mental health. “I wouldn’t be surprised if a lot of people are struggling with sleep, stress, and mental health, and weight loss might actually be a way to address these other concerns”.

The challenge with weight loss is that 30-40% of it can come from muscle or bone, which the body taps into, he noted. This means it’s crucial to maintain fitness to preserve muscle and bone health. Otherwise, people become more prone to fractures and falls. “Fitness should matter more to people using these products for weight loss,” and this underscores the need for more education on the importance of preserving fitness while losing weight.

This does offer a key opportunity for supplements that address the dual challenge of weight loss while supporting muscle retention, bone health, and overall fitness, he noted.

Educating consumers on the importance of staying fit while losing weight, combined with the development of specific supplements, could position companies to meet an unmet need in the market.

Do GLP-1 users need to take probiotics?

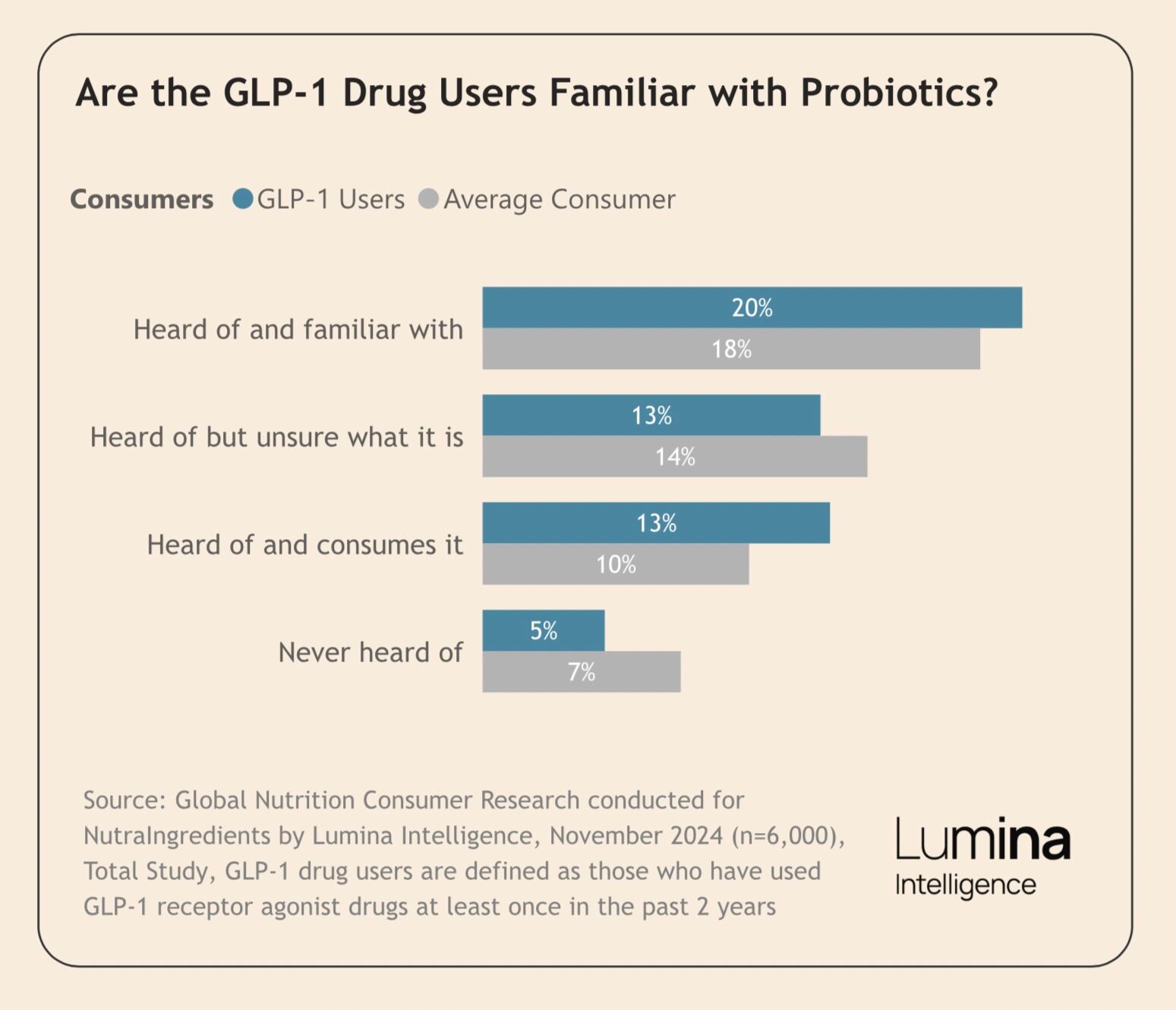

GLP-1 consumers appear to be actively seeking biotic solutions according to the data, with a higher usage of probiotic products among GLP-1 users (13% compared to the general population’s 10%).

“This indicates a heightened awareness of such products, though the overall percentage remains relatively small,” said Sibley.

Some solutions are already being developed to complement GLP-1 treatments, and this “signals a third wave of innovation” he noted.

“Side effect mitigation, improved nutrient absorption, and viable alternatives for those unable to access or continue the drugs is going to be really big in this space.”

From identifying emerging trends to understanding the motivations behind consumer decisions, Lumina Intelligence insights are designed to fuel your success. For more information about how Lumina Intelligence can help you to navigate opportunities in the health, wellness and nutrition market please contact Ed Sibley direct on Ed.Sibley@WRBM.com