Ten Member States currently allow the use of the term “probiotics” on product labels, but the lack of harmonization is a cause for ongoing concern, along with the lack of an EFSA health claim for “probiotics”.

As reported recently by NutraIngredients, the European Ombudsman recently announced it had found no maladministration by the European Commission in how it addressed concerns about its stance on probiotic foods and supplements being systematically classified as health claims based on a non-binding 2007 guidance.

“Establishing a more consistent and unified regulatory framework across Europe is essential in providing legal clarity, strengthening consumer protection and allowing for continued innovation in the food sector,” said George Paraskevakos, executive director of the International Probiotics Association (IPA).

“Products with probiotics are widely used by consumers globally, and the timing for this would have served as a great occasion to lay some foundation towards regulatory harmonization to industry, regulators and consumers.“

The market

Prior to 2009, Europe was the number one market for probiotics, but now ranks third after China and the United States. In Europe, the retail value of probiotics, (sour milk products, yogurts and dairy-based beverages, food supplements), was around € 10 Billion in 2023, according to IPA Europe.

The market is dominated by five counties—Germany, France, the U.K., Italy and Spain, according to IPA Europe. These represent approximately 60% of the European market of probiotic supplements.

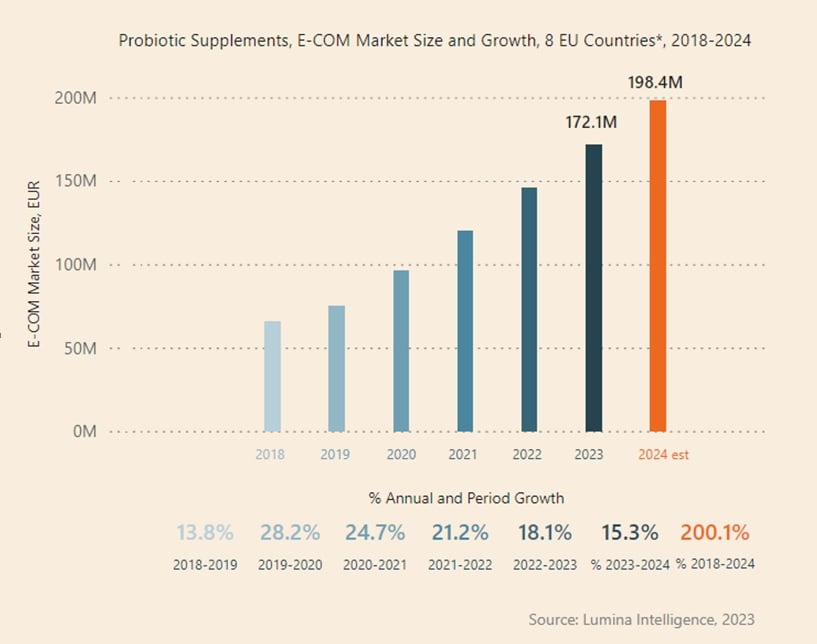

While online sales of probiotic supplements in 8 EU countries* surged during the pandemic with growth rates of 25% reported in 2020, data from Lumina Intelligence shows that this has slowed. Despite the post-pandemic readjustment, Lumina data still estimated 15.3% YoY growth in 2024 to yield sales of almost €198 million (adjusted for inflation), and that was after 18% and 21% YoY growth reported in 2022 and 2021, respectively.

Formulators and marketers also need to factor in consumer understanding, and here work still needs to be done. For example, a survey of 8,000 consumers across eight European countries commissioned by IPA–Europe and performed by 3Gem** highlighted the impact of the restrictions around use of the term and the level to which consumers feel informed about the beneficial microorganisms. Indeed, the survey found that consumers in seven out of the eight countries reported they did not feel informed about probiotics contained in commercial products.

Formats

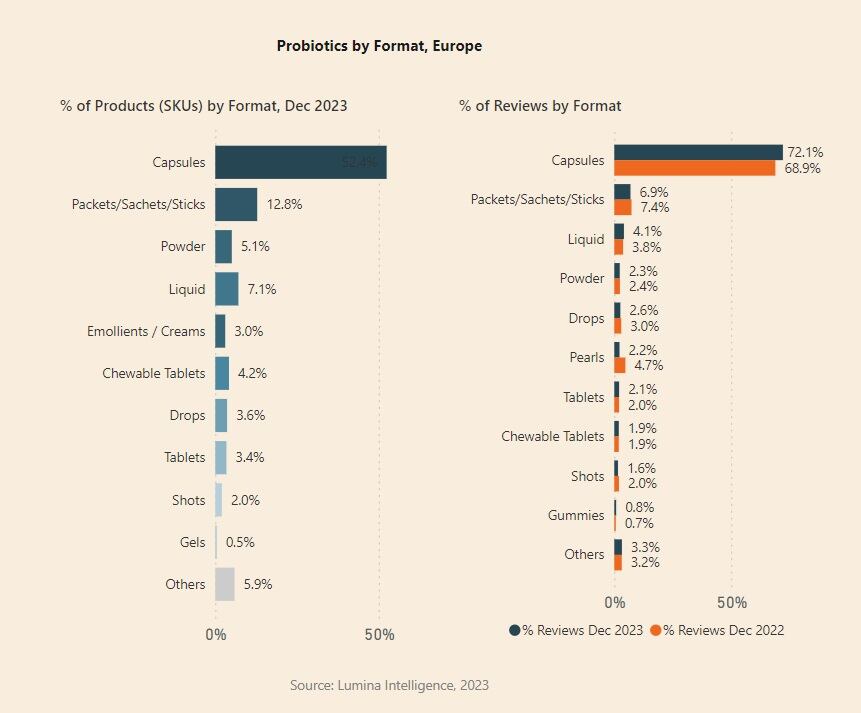

Capsules dominate with over 50% of the market (2023, Lumina Intelligence), with packets, sachets and sticks a distant second with 12.8%. Interestingly, gummies and chewables are a tiny section of the European online market, representing less than 5% of all SKUs.

The wider -biotics opportunity…

Lumina also offers some insights into prebiotics and postbiotics in the online space.

According to Lumina analysts in Sweden and Finland, where awareness and understanding of “probiotics” is relatively high, post- and prebiotic products are still less well-known. Insights from Sweden revealed that “consumers are likely to opt for combination products such as Husk brand containing probiotics and prebiotic fibers.”

In Finland, “the market for prebiotics and postbiotics is less developed and there is lack of products”, said an analyst. Again, “prebiotics are often found in combination products including both pre- and probiotics”.

The picture for postbiotics is complicated by the fact that the term “postbiotic” is rarely used, being replaced by other terms such lysates, heat-killed strains, parabiotics, short-chain fatty acids, fermentates and many more.

While the emergence of postbiotics creates further challenges to the overall sector as consumers are exposed to yet another -biotics term, postbiotics lend themselves to greater inclusion in gummies and chewables, compared to probiotics, which need to remain viable and therefore spore-forming strains or encapsulation techniques are typically employed.

* EU countries tracked by Lumina: Belgium, Germany, Spain, Finland, France, Italy, Poland, Sweden.

**The IPA-Europe, 3Gem survey focused on Italy, Denmark, the Netherlands, Spain, Poland, Belgium, Germany and Sweden. Poland was the only country where more consumers felt informed than non-informed about probiotics.