Time is of the essence

Megan Olsen, assistant general counsel for the Council for Responsible Nutrition, noted that the market for CBD products is exploding, with multiple product forms available with a wide range of quality.

“FDA does not have the luxury of time. It must act quickly to address a market that is out of control,” Olsen said in her public comments at the meeting. Olsen said CRN viewed with some alarm FDA’s initial forecast of a three-to five-year timeline for construction of a final framework for CBD regulations.

“We do not believe the safety debate has to impede rule making,” she said.

Olsen was one of more than 100 registered speakers at the meeting. Each speaker was given a nominal two minutes for their comments. In addition, most speakers also said they were planning to file written comments as well. The deadline for written comments on this issue is July 2.

Another speaker was Michael McGuffin, president of the American Herbal Products Association. AHPA has had a working group on cannabis for a number of years.

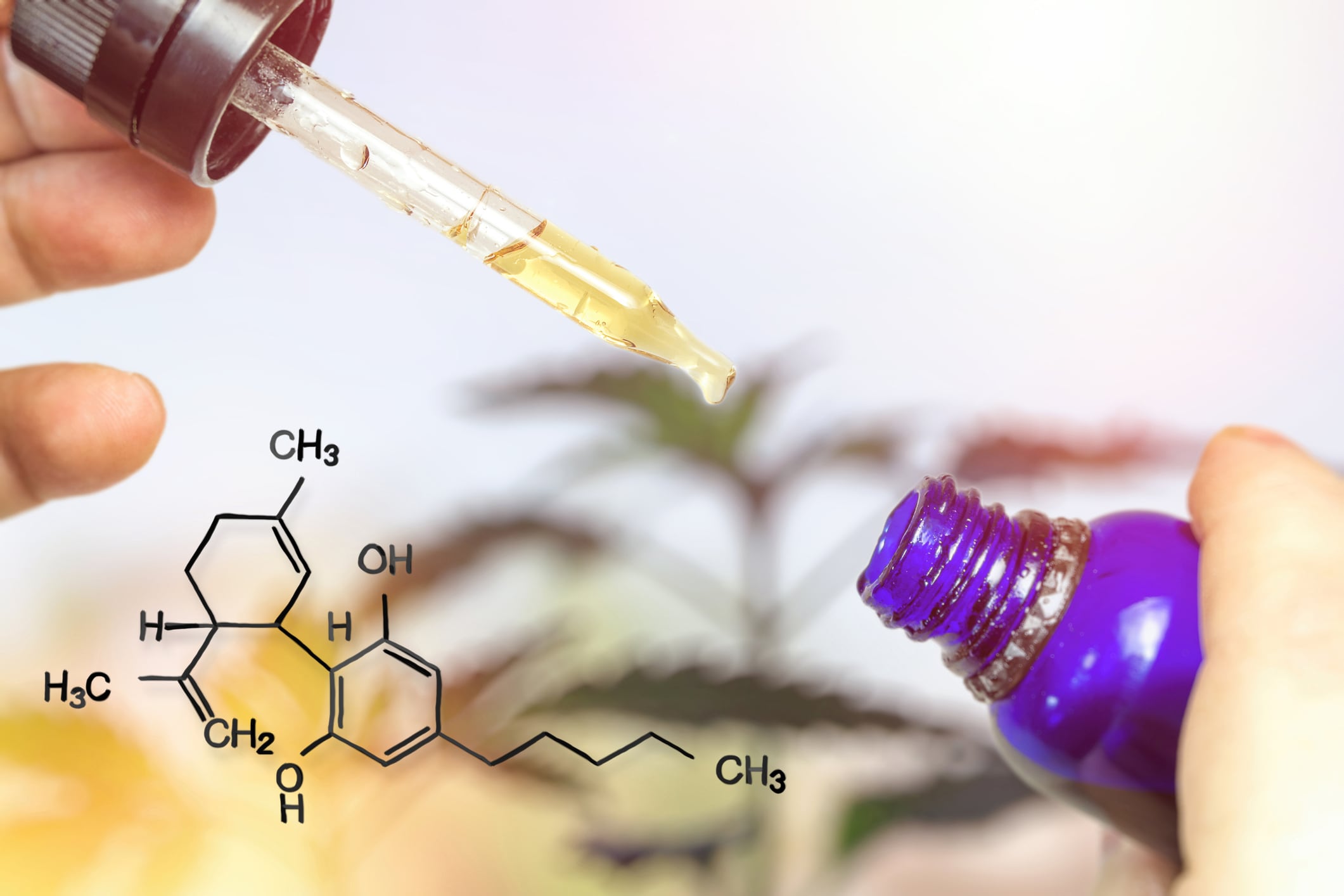

McGuffin emphasized that the 2018 Farm Bill reflected the will of Congress that there should be a legal pathway for hemp derived products to come to market. McGuffin said AHPA’s view is that simple extracts, tinctures and other hemp derivatives that do not seek to concentrate the level of CBD beyond what is present in the raw material should be allowed as legal dietary ingredients.

Several speakers echoed CRN’s concern about the time pressure FDA is under. Some speakers representing the agricultural sector sounded a warning about the rapid expansion of hemp production in China and other countries. If FDA and/or Congress takes too much time solving this issue, US farmers will lose critical market share, they said.

Questions about ad hoc medical usage

Judging from the questions FDA panelists addressed to some of the speakers, it’s clear that the agency has concerns about safety, dosage determination and product quality. Several speakers responded equivocally about how much CBD consumers might be getting when all of the various product forms are taken into account.

For example, New York physician Dr Russell Kamer, MD, an internist who spoke on behalf of the firm Partners in Safety, a company that provides occupational health services and drug screening, said CBD is a daily fact of his clinical practice. He likened the current enthusiasm around the substance to an earlier strong push from consumers in the 1970s for the approval of laetrile, a now discredited cancer therapy derived from peach pits.

“Every day I see a patients who are taking CBD. They are buying it in drug stores, online, from chiropractors, in gas stations and in flea markets. Most of these products have no independent lab analysis,” he said.

Another physician, Dr Kevin Chapman, MD, a pediatric epilepsy specialist in Colorado, said many families in his state are self treating their children with CBD products to address seizure disorders. While FDA has approved the drug Epidiolex, it has only been approved for two fairly rare disorders: Dravet’s Syndrome and Lennox-Gastaut Syndrome. For other children, families are taking matters into their own hands. When asked how those families are determining dosages, Dr Chapman replied, “They’re making it up as they go along.”

Attorney: FDA will need answers before proceeding

Attorney Johnathan Havens, of the firm Saul Ewing Arnstein & Lehr, who planned to attend the meeting, spoke with NutraIngredients-USA before it began. He cautioned those in industry against expecting too much from the today’s proceedings.

“I think FDA is asking some tough questions that don’t have easy answers. Such as, how can you be sure how much CBD a user is getting, when you don’t even know what products they are consuming that have CBD in them? If the average consumer using a CBD/hemp topical for their joints and a CBD dietary supplement on a daily basis, that could be 500 mg a week,” he said.

Haven said like many other attorneys in the industry, he has had numerous contacts from clients wanting advice on CBD. And many of those clients were viewing today’s meeting as the first kick of a ball they anticipated will roll quickly downhill. Not so fast, he said.

“I think there is a notion here that FDA is educating itself so that if it decides to go down this regulatory pathway it will know what it’s getting into. After they digest what they’ve heard today and after they digest all the written comments, then, sure, we’ll have more of an idea of what the future looks like,” he said.