Consumer demand has shifted away from sugar and other traditional sweeteners such as sucralose, saccharin, aspartame, and even agave, Nielsen pointed out.

The sugar and sweetener category has declined year on year in both dollar (-2.1%) and unit (-3%) sales in the 52 weeks to July 28, 2018. The category has been on the decline over the past four years, with dollar sales (-4.5%) and unit volume consumption (-4.1%) of sugar down over the period with a declining compounded annual dollar growth rate of 1.7% over the past three years.

Conversely, sales of no sugar added products grew across several retail categories including liquid coffee (+55%), granola bars (+35%), fresh meat (+12%), pasta sauce (+9%), water (+8%), and yogurt (+4%), according to Nielsen Product Insider data for the 52 weeks ended April 7, 2018.

However, this does not mean American consumers’ sweet tooth has mellowed as sweetener alternatives to sugar including stevia and monk fruit have grown in popularity over the same time period.

In fact, sales of products that claim to contain stevia grew 17% during the week of Aug. 31, 2018 compared to the same week last year.

“Just like no added sugar products, stevia is having a natural halo effect across the store,” Nielsen said.

Products sweetened with stevia have done especially well in traditionally indulgent categories such as frozen desserts, chocolate, and fruit drinks.

Monk fruit is also making moves across the grocery aisles specifically in the dairy case, where lactose-free milk using monk fruit posted a 155% increase in sales for the 52 weeks ended April 7, 2018.

Monk fruit is also finding success in slower growth categories such as cereal (+24%) and nutrition bars (+20%).

What’s the next stevia?

Looking at the sales success of stevia and monk fruit shows that specific ingredients can drive growth among various categories.

“So this begs the question: How can fast-moving consumer goods (FMCG) companies know if an ingredient has the potential to become a sales growth driver? What will be the next stevia, for example?,” Nielsen posited.

Nielsen analyzed 30 ingredients to assess each of their growth trajectories and plotted them on a grid according to their category maturity (or incubation stage).

Examples of ingredients analyzed include guayusa, rhodiola rosea, yerba mate, moringa and algae, among others.

Rise of Ayurvedic ingredients

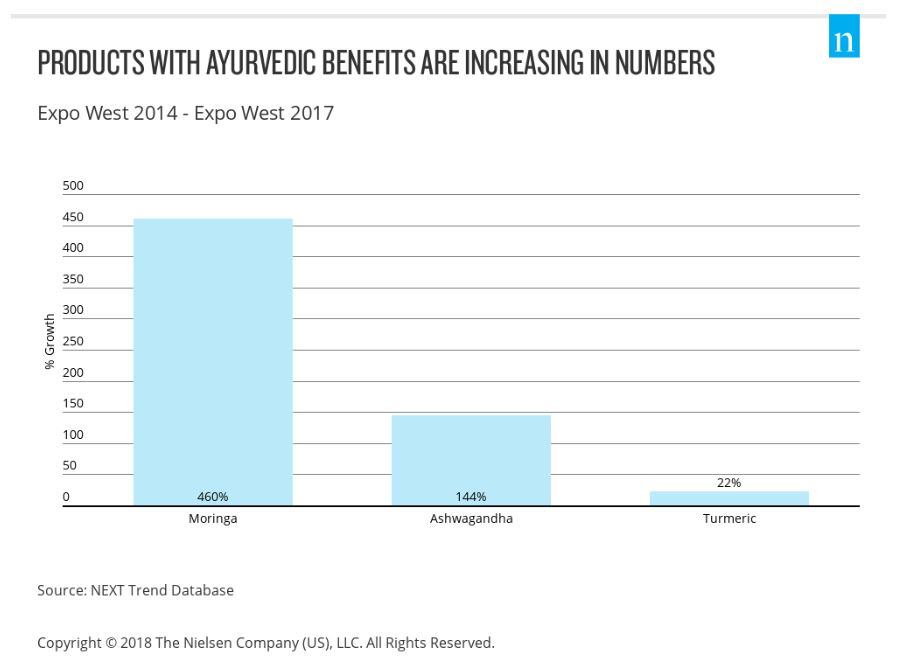

While Ayurvedic medicine, an ancient holistic healing system, hasn’t made its way into mainstream vernacular, several ingredients (e.g. turmeric, ashwagandha, and moringa) associated with Ayurveda medicinal benefits are seeing strong growth.

“Several ingredients in this space have captured the attention of innovators and consumers alike. And as a result, Ayurveda is indirectly finding its way into innovators’ tool boxes and consumers’ shopping carts,” Nielsen said.

Among the Ayurvedic ingredients, turmeric is the most mature in terms of consumer awareness of its anti-inflammatory and antioxidant properties as well as its market availability. Turmeric registered $11bn in 2018, and can be found in more than 100 products across the store and sales of products.

According to Nielsen research, 60% of consumers who purchased turmeric did so to prevent a personal condition and 24% bought turmeric to treat a condition.

“Compared with turmeric, ashwagandha and moringa, which are also known for their Ayurvedic benefits, have some catching up to do, as they are still in their innovation stages,” Nielsen stated.

Moringa showing signs of ‘ingredient prodigy’

Moringa, a nutrient-rich green plant that thrives in hot, dry climates such as West Africa and parts of South America, is “showing signs of ingredient prodigy” outpacing other similarly positioned ingredients such as ashwaganda and “dethroning kale’s reign as the most nutrient dense green”.

While appearing in an increasing number of products such as Kuli Kuli’s packaged bars and protein powders at Whole Foods stores across the US, moringa has just a 3% household penetration, according to Nielsen.

“Given Americans’ continued exploration into deeper health and wellness areas, however, brands have an opportunity to capitalize on the benefits of both Moringa and ashwagandha through increased consumer awareness initiatives and product labeling,” Nielsen added.