And it’s got there without coupons, loyalty cards, print or TV advertising, or a corporate presence on social media, notes Susan Porjes, senior market analyst at Packaged Facts and the author of a new report ‘Trader Joe's and the Natural Food Channel’.

“No one else has the same assortment of merchandise because about 80% of Trader Joe’s inventory is composed of private label items.

“Trader Joe’s is also unparalleled because it embraces a combination of gourmet, natural/organic, and ethnic/multicultural foods rather than focusing on just one of these sectors—and it does so at far lower prices than upscale specialty grocers and most natural foods stores. Moreover, the chain’s incomparable atmosphere makes it a fun destination rather than a tedious shopping trip.”

Trader Joe’s has never tried to be everything to everybody

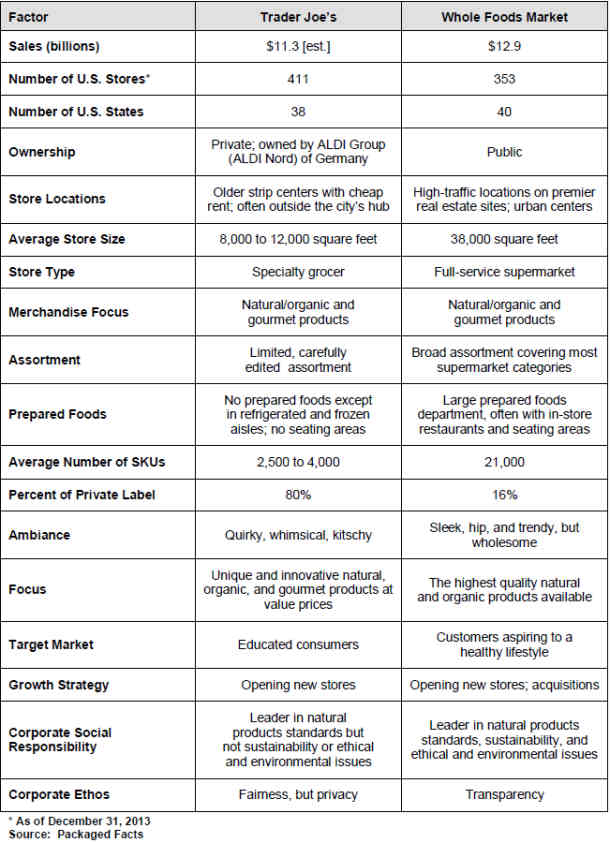

Notoriously secretive (it’s owned by a family trust set up by Theo Albrecht, one of the brothers behind German discount chain ALDI), Trader Joe’s 2013 sales were estimated to be up 7.6% to $11.3bn (Supermarket News data), from 411 stores in 38 states, with its largest concentration of stores (40%) in California, said Porjes.

Trader Joe’s also proves that less can be a lot more, when it comes to grocery retailing, carrying less than 4,000 skus in stores that typically measure just 8-12,000sq ft, she added.

“Trader Joe’s has never tried to be everything to everybody. In fact, from its very inception, the chain never intended to completely replace conventional supermarkets for the average weekly shopping trip; thus, national brands were not necessary.”

Kitschy? You bet. But the formula works

It also keeps things interesting by varying its assortment rapidly, she said: “If products don’t sell, they are quickly routed out so new products can be added.

“Added to that is an offbeat atmosphere where Hawaiian shirts are the standard work uniform, stores are designed with a tropical island theme, store managers are called ‘captains,’ and the friendly employees are ‘mates.’ Kitschy? You bet. But the formula works.”

Successive consumer surveys by Consumer Reports in 2006, 2009 and 2012 have ranked Trader Joe’s the nation’s second-best supermarket chain after Wegmans, she observed.

Trader Joe’s targets singles, couples, and small families

As for who shops at Trader Joe’s, it targets “singles, couples, and small families with its comparatively small package sizes, eschewing large families and bulk buyers”, said Porjes.

As for demographics, data from Simmons National Consumer Surveys reveals that more than 22% of Trader Joe’s shoppers have a graduate school degree (vs. less than 10% of all U.S. adults), while a further 28% are college graduates (vs. 16% in the general population).

But while 46% of Trader Joe’s shoppers have an annual household income of $100,000+, households earning $25K to $99K account for just as many of its shoppers, said Porjes.

Whole Foods v Trader Joe’s: ‘The striking differences between the two chains are what keep the same consumers shopping at both.’

While its offer is very different, Trader Joe’s is considered by Whole Foods Market (354 stores in 40 US states, plus 8 in Canada, 8 in the UK, 2013 sales +10.3% to $12.9bn) to be its #1 competitor, not least because the two chains attract a very similar customer base (educated, tech savvy, health conscious), she added.

Whole Foods’ co-CEO John Mackey told Businessweek.com on February 14, 2013: “We consider them our main competitor… 365 [Whole Foods’ private label range] is geared to match Trader Joe’s prices.”

However, “the striking differences between the two chains are what keep the same consumers shopping at both,” claimed Porjes.

“At Whole Foods, the focus is premium quality and huge selection… At Trader Joe’s, the focus is a sharply edited assortment of great products at great prices. It has much smaller selections and not nearly as much variety to offer when it comes to fresh produce, meats, seafood, and prepared foods.

“There is also a vast difference in their marketing thrusts. Whole Foods’ intent is to promote sustainability, responsible sourcing, and the concept that by buying products at its stores, consumers are supporting not just organic foods, but a production model that benefits local farmers, people in third-world countries, and the environment.

“In contrast, the marketing thrust of Trader Joe’s, with its whimsical atmosphere and newsletters, is that it is here to make shopping fun.”

Click HERE for more information on ‘Trader Joe's and the Natural Food Channel’ from Packaged Facts.

Click HERE for details about the companion report: 'Whole Foods and the Natural Food Channel'.