Approximately 6% of Americans currently use GLP-1 receptor agonist drugs, equivalent to about 20 million people.

This year’s McKinsey Future of Wellness survey noted that younger generations are finding it difficult to stay motivated to exercise and manage their weight. It also reported that a 12% year-on-year increase in the use of nutritionists for weight management programs, along with a 6% rise in the number of respondents taking weight loss supplements.

That last data point is at odds with actual sales data from both SPINS and NielsenIQ.

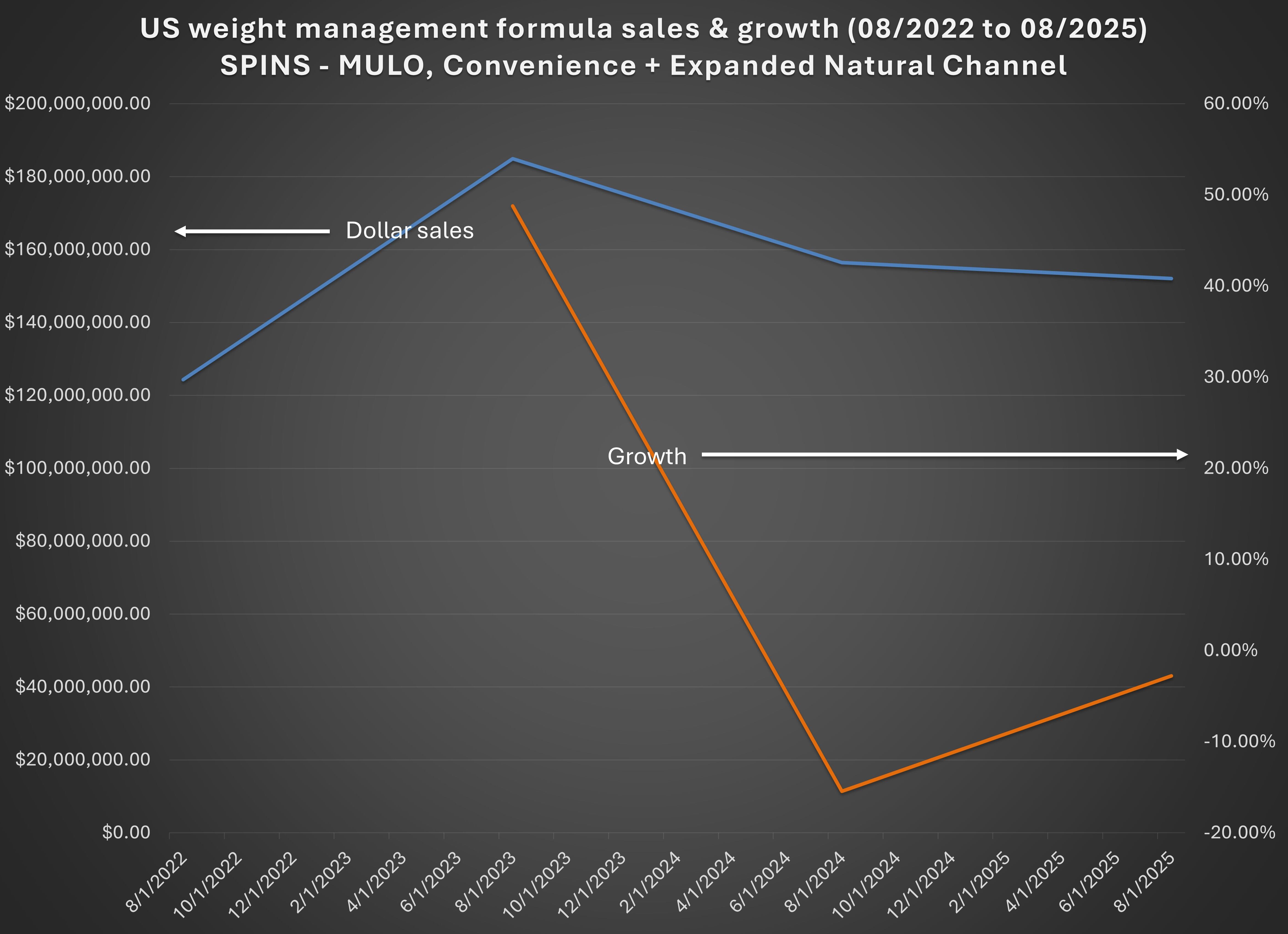

According to SPINS, combined sales of weight management formulas in the mainstream + convenience and natural expanded channels decreased almost 3% over the past year, from $156.4 million in August 2024 to $152 million in August 2025. On Amazon, sales declined from $216.5 million in August 2024 to $186.8 million this year. That’s a drop of almost 14%.

Unit sales tell an even more dire story, with Amazon unit sales declining almost 16% year-on-year, compared to 12% for weight management formulas in the mainstream + convenience and natural expanded channels.

“Overall, the weight management supplement category is being challenged, in particular by consumers (such as GLP-1 consumers) who are using other avenues for weight management as well as by other categories, like functional beverages where we are seeing more weight management ingredients and claims,” Sherry Frey, vice president of total wellness at NielsenIQ, told NutraIngredients.

NIQ’s data bears this out: While overall dietary supplement dollar sales are up 17% year on year and up 32% from two years ago, overall sales of weight management supplements are down 22% compared to last year and 29% compared to two years ago, Frey said.

GLP-1 adjacent categories and other product categories are benefiting from the move away from traditional weight management supplements, she added.

This should be no surprise to industry: Retailers like GNC, The Vitamin Shoppe and iHerb were quick to pivot and start talking about supporting the side effects of GLP-1 drug use like nutrient depletion, muscle loss, skin health and gastrointestinal issues.

Growth in digestive, blood sugar management and beauty supplements

“We’re seeing some functional health-related benefits for weight loss/management growing within beverages, such as obesity support and metabolism support,” Frey said. “As it relates to GLP-1 users, we see they decrease weight management supplement usage but increase their digestive, diabetic and beauty supplement purchasing.”

Use of weight management supplements by GLP-1 users is down a whopping 54%, she said, while digestive, diabetic/blood sugar management and beauty supplement are up 52%, 265% and 42%, respectively.

There are already examples of brands adjusting to this new normal. Hydroxycut, one of the leading mass retail weight loss brands in North America, expanded its portfolio in mid-2024 to include Hydroxycut Pro Clinical Glucose Support and Pro Clinical Berberine DHB.

The weight management category is being reshaped by growing use of GLP-1 weight-loss medications, spurring demand for “protein- or nutrient-fortified foods, gut health products intended to address digestive discomfort and workout programs focused on building and maintaining muscle mass,” stated the McKinsey Future of Wellness survey report.

Products formulated with probiotics, prebiotics and postbiotics are also launching onto the market, some with specific GLP-1 labeling. For example, ResBiotic launched the resM GLP-1 Postbiotic earlier this year formulated with heat inactivated L. plantarum RSB11 combined with a botanical blend containing extracts of white mulberry leaf and fenugreek seeds.

As NutraIngredients reported last year, Akkermansia is leading the way in 76% of all the biotics products making GLP-1 claims on Amazon USA, according to Ewa Hudson, director of insights at Lumina Intelligence. Hudson told NI that there were 75 supplement products making GLP-1 claims in Nov. 2024, with 38 of those being biotic products.

Even among the prebiotic-only products making GLP-1 claims, there is also an indirect play for Akkermansia, because some prebiotics may increase levels of the bacterium. For example, SuperGut’s GLP-1 boosting prebiotic mix is formulated with a combination of resistant starches, including Solnul, which has been reported to boost Akkermansia levels and increase free fatty acids.

SPINS data shows that sales of weight management probiotics declined by almost 12% from $7.3 million in August 2024 to $6.4 million in August 2025. However, sales of weight management probiotics on Amazon have surged 84%, from only $3.3 million in 2024 to $6.4 million this year.

The weight management category is being reshaped by growing use of GLP-1 weight-loss medications, spurring demand for “protein- or nutrient-fortified foods, gut health products intended to address digestive discomfort and workout programs focused on building and maintaining muscle mass”.

McKinsey Future of Wellness survey report

Weight management products over-index online

Probiotics, taurine, yerba mate and L-carnitine were the only functional ingredients showing growth of 20% or more year-on-year on Amazon, according to SPINS. The overall weight management formulas category on Amazon decreased 14% from $216.5 million in 2024 to $186.8 million in 2025.

Looking at the wider online space, NielsenIQ reports that online sales are down 22% year-on-year, even though the market share of online sales of weight management supplements has increased, from 66% two years ago to 73% today.

“For comparison, about 62% of all supplements are sold online so weight loss supplements are more heavily sold online than overall supplements,” Frey said.

Rays of hope from the natural channel

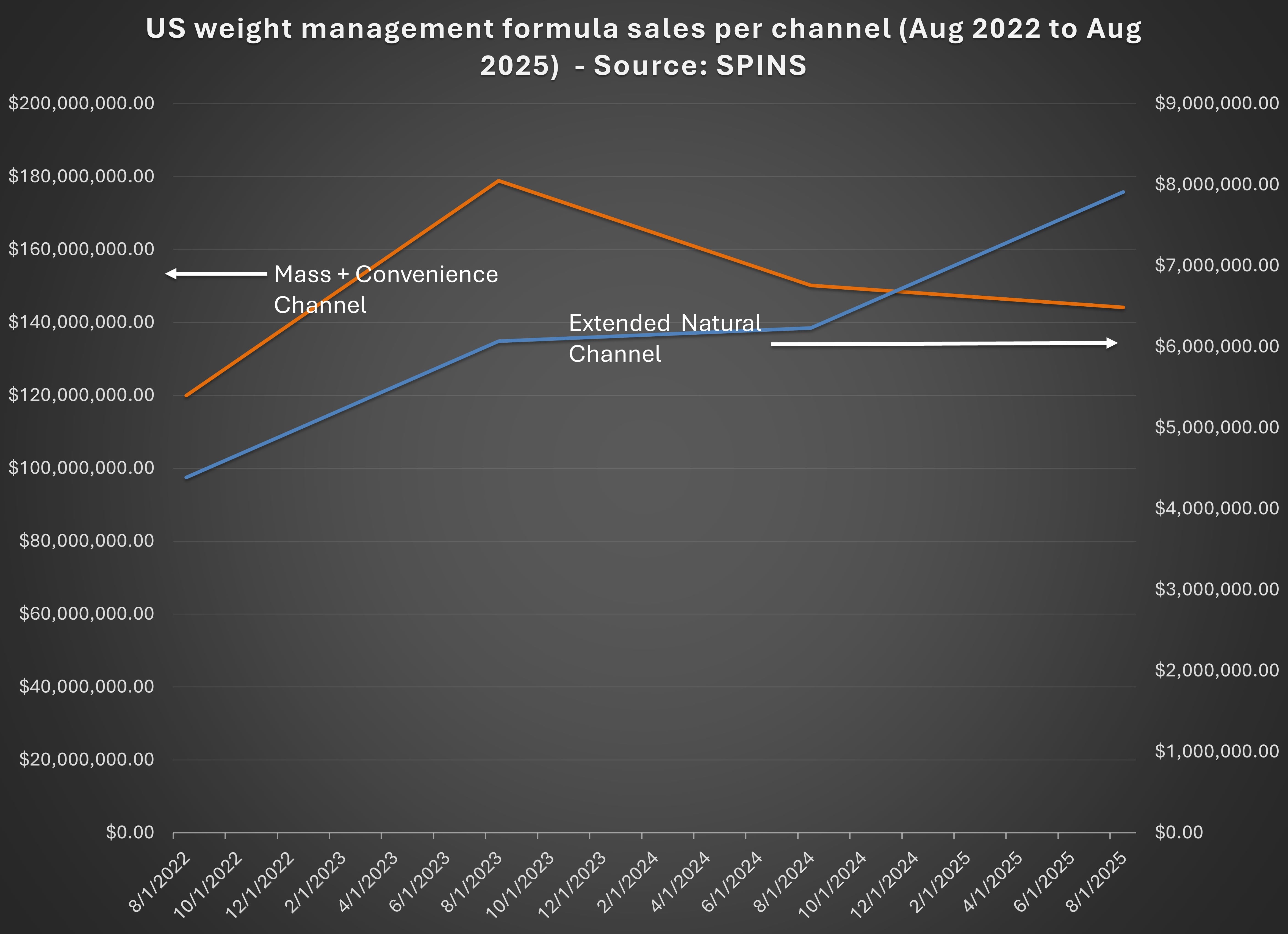

While overall sales have declined, data from SPINS offers some room for hope: Sales of weight management formulas in the natural expanded channel grew 27% from 2024 to 2025 (the big decline in the much larger mainstream channel hides this increase in the overall numbers).

The top functional ingredients for growth were collagen (up 126%), green tea (up 14%), chromium (all forms – up 77.5%), orange peel extract (up 8%) and barberry (a.k.a. berberine, up an eye-popping 5,617%).

Speaking with NI at Expo West 2025 in Anaheim, Scott Dicker, senior director of market insights at SPINS, said: “Not everyone wants to take these [GLP-1] drugs. A lot of people want to try [natural] products first. We’ve seen berberine continue to do well ever since it was dubbed #naturesozempic.”

* SPINS data is derived from sales in the mainstream and natural channels: The mainstream channel (i.e., the multi-outlet channel powered by Circana [previously IRI]) includes grocery stores, drug stores, and mass merchandisers such as club, dollar, and military stores. The natural channel includes co-ops, associations, independent retailers, and large regional chains (excluding Whole Foods Market and Trader Joe’s).