BGG folds astaxanthin, future algal ingredient development into new subsidiary Algae Life Sciences

The newly formed division is a partly owned subsidiary with BGG as a majority shareholder. The company has hired Joe Huff, who has a long history in the US supplement industry as CEO and has brought on Bob Capelli as executive vice president of global marketing. Capelli spent more than a decade working with the antioxidant carotenoid at Hawaiian producer Cyanotech, which has increasingly moved toward a vertical positioning as a finished goods manufacturer.

Capelli spoke with NutraIngredients-USA about the new company and the direction it intends to take.

“We are going to use a lot of the services offered by BGG. Their quality is as good as anyone’s in the world in every ingredient they sell,” Capelli said. Even in botanicals which have a history of adulteration, such as bilberry, BGG, which was founded in 1997, has a reputation of delivering goods that meet spec, Capelli said.

“They wanted to come out with a dedicated algae company because they believe algae is going to a huge, growing end of the supplement market in times to come,” Capelli said.

Demand created distortions

The astaxanthin market has seen remarkable growth, boosted in large part by high profile mention of the ingredient on the Dr Oz Show in 2011. While the influence of the show seems to have waned in recent years, especially after Oz’s uncomfortable testimony before a Congressional committee, the show had great traction in the marketplace at the time. Demand for astaxanthin spiked by an order of magnitude almost overnight, and that stretched the market to the breaking point and at least for a time damaged the ingredient’s credibility in the eyes of potential customers, Capelli said.

“Astaxanthin has taken its lumps because of the supply problems. From 2011 every supplier was limiting orders or delaying orders at the very least and that went on through 2014. Some brands were limiting shelf space. Among some companies in the industry there was a real question about the viability of astaxanthin because many people just couldn’t get it,” he said.

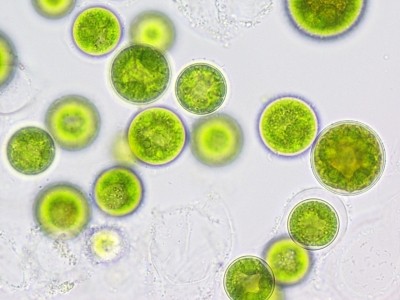

That demand brought other players into the market. Most prominently was Dutch ingredient supplier DSM, which started to market its own synthetic form of astaxanthin as a supplement ingredient. Prior to that the ingredient was restricted to use as a colorant in fish feed to give the flesh of farmed salmon a healthy-looking pinkish hue. From the point of view of BGG and other suppliers of algal astaxanthin (which is derived from the species Haematococcus pluvialis), the synthetic form, because of its sterioisomer structure, cannot be said to have the same health benefits as the algal varieties. Capelli said that parent company BGG is a full member of the Natural Algae Astaxanthin Association (NAXA), which seeks to communicate the benefits of the natural forms, and that he has been participating in conference calls with the organization for several months.

But the plans for the new company don’t stop with astaxanthin, Capelli said. The goal is to bring other algal ingredients online. The company is looking longer term at potentially deriving ingredients from marine species of algae, which would imply developing another site with access to salt water, he said. The first targets beyond astaxanthin include fucoxanthin and fucoidan, Capelli said.