Which supplement brands are people buying online?

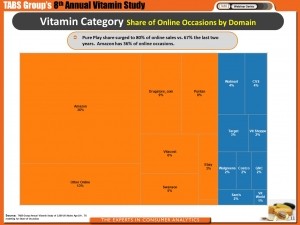

Online is the number one outlet, according to data from the TABS Group’s 8th Annual Vitamin and Sports Nutrition Study, and is dominated by pure play online retailers (versus retailers with both an online and a bricks-and-mortar presence), there was a decline in the size of this sector, he said. Pure play online retailers share surged to 80% of online sales versus 67% in 2013 and 2014. The largest online retailer is Amazon, with 36% of the sector (see slide below).

Online vitamin sales hit $1.9 billion surpassing Walmart’s sales of $1.7 billion in 2014, a slight increase over 2014. However, online’s share of occasions (a proxy for share) of the vitamin category dropped from 9.9 in 2014 to 9.7 in 2015, the first time online share has dropped since the inception of the TABS Group survey in 2005.

Dr Kurt Jetta, CEO and founder of the TABS Group, told attendees to its 8th Annual Vitamin and Sports Nutrition Study “Given that vitamins is among the most highly developed online categories in the consumer packaged goods (CPG) industry, this study adds an important data point that suggests online sales in CPG have peaked with the existing online shopping technology.”

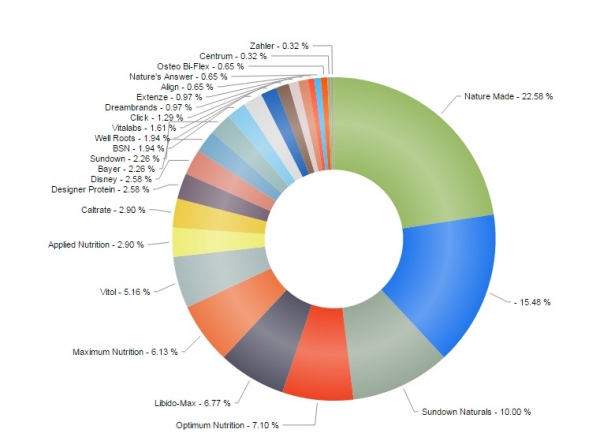

Using sales data from JeeQ Data LLC, NutraIngredients-USA is able to show which brands are ruling the roost on Amazon.com, RiteAid.com, Sears.com, Target.com and Walmart.com

JeeQ Data is a new company and was founded by former Microsoft and Amazon.com employees.

“With our service, you can track top selling food and drugs, electronics, books, home and kitchen products, clothes, shoes and almost any retail category products with just a few clicks,” explained Kevin Zhang, the founder of JeeQ Data. “The summary report can be categorized by brand, model, manufacturers etc, so you know which brands or models are selling the best in the past week or past month, the price changes history and other top selling trends.”

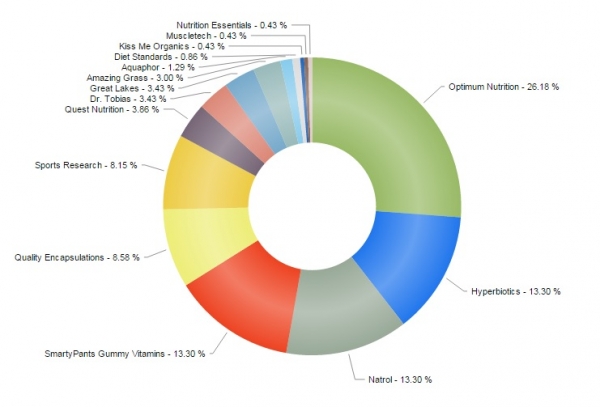

Amazon.com

The data from Amazon.com allows for a breakdown of the category into several sub-categories, including pre-natal and Ayurvedic supplements. As can be seen from the first figure, the top selling brand in September in the vitamins and dietary supplements category was Optimum Nutrition with its 100% Whey Gold Standard and Creatine Powder selling well. The second bestselling brand is HyperBiotics with its PRO-15 product topping the individual sales charts. Other brands in selling well include Natrol and SmartPants Vitamins (see below)

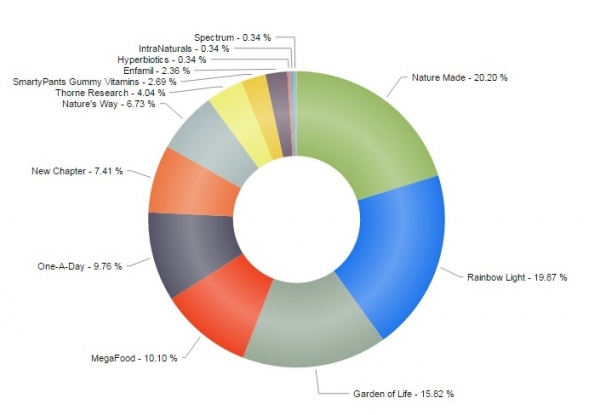

The bestselling pre-natal brand is Nature Made, followed by Rainbow Light, Garden of Life, and Mega Food.

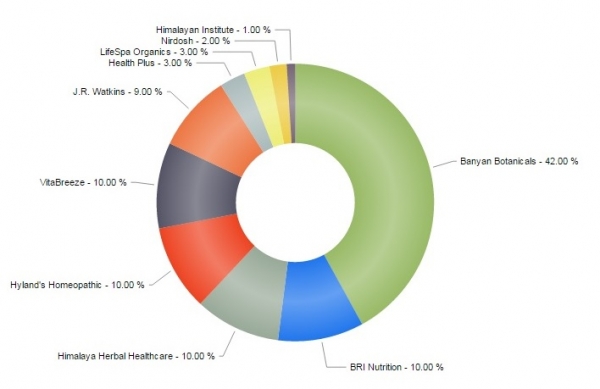

In the Ayurvedic space, Benyan Botanicals dominates. The 42% figure represents the best seller appearance “share” for September for that brand, followed by four brands with 10%.

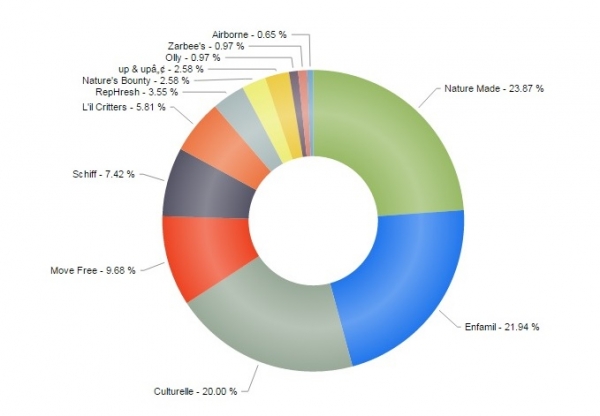

Target.com

Nature Made are strong on Target.com, with a 24% best seller appearance “share” for September on Target.com. Other bestselling brands include Enfamil, Culturelle, and Schiff.

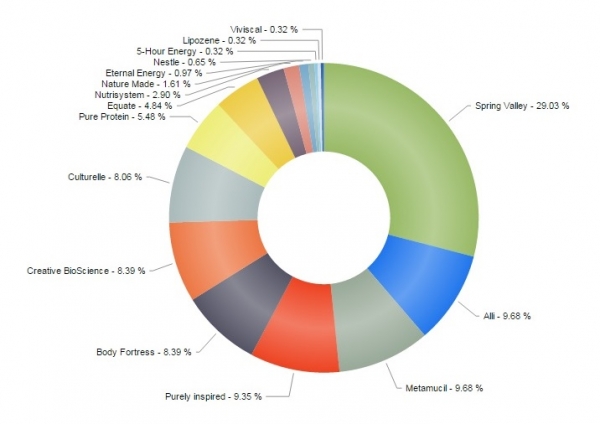

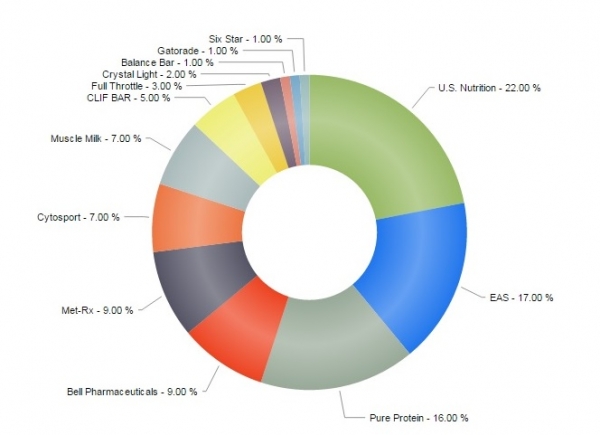

Walmart.com

Data from Walmart.com shows the general vitamin category and sports nutrition. For the former, the retailer’s own brand, Spring Valley, is the top selling brand, with a 29% best seller appearance “share” for September. His is followed by brands such as Alli and Metamucil.

In the sports nutrition space, US Nutrition is the bestselling brand, with 22%, closely followed by EAS with 17% and Pure Protein with 16%.

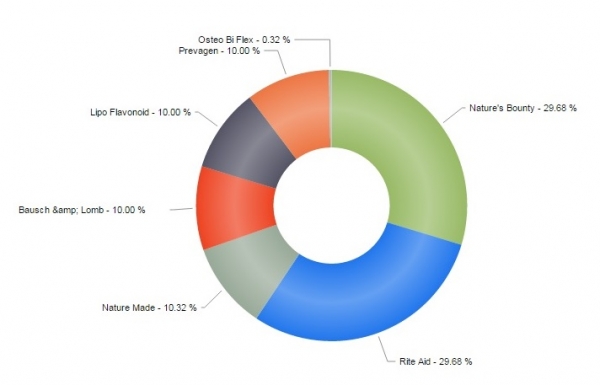

RiteAid.com

Nature’s Bounty is the bestselling brand on RiteAid.com, with 30% in September. This is followed by RiteAid’s own brand products, and then Nature Made and Bausch & Lomb.

Sears.com

Nature Made surges back into first place on Sears.com, with a 23% best seller appearance “share” for September of vitamin supplements on that site.