Turning quality narrative around complicated by years of sourcing based on lowest price, expert says

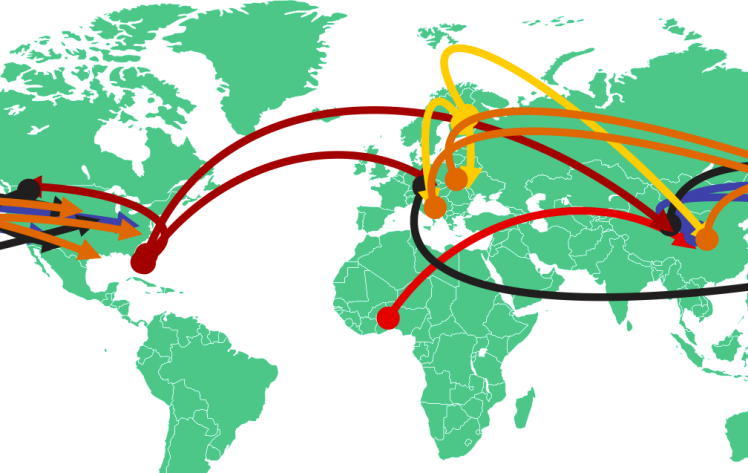

Cal Bewicke, co-founder and CEO of California-based ingredient supplier Ethical Naturals Inc., made a presentation on the subject at the Raw Materials & Supply Chain Summit put on recently by the United Natural Products Alliance in Salt Lake City. Bewicke said a market development, decades long in the making, has produced a supply chain in which many ingredients come into the country based upon price rather than strict quality controlled factors. These ingredients are handled through what he called contract warehouse distributor operations that operate primarily on price, with quality controls as only a secondary consideration.

The centerpiece of the meeting was an announcement by GNC that it will institute immediately a set of raw material GMPs for its own supply chain. Their 58-page draft document, which built upon earlier work by the American Herbal Products Association and the American Herbal Pharmacopoeia, will go through a revision process that is open to industry comment and will be managed by AHPA. GNC’s hope is that the program will become a blueprint for industry.

Raw material suppliers up to now have been exempt from GMP requirements and have had only to comply with food GMPs that govern general sanitation and controls against contamination from microbes, insects, rodents or other animals. Up to now, it has been the exclusive responsibility of manufacturers to ensure the quality, potency and purity of incoming raw materials and to conduct appropriate tests.

Opportunities to cut corners

That “pull” scenario in which the need for manufacturers to ensure their incoming raw materials are GMP compliant would de facto raise the compliance bar for the raw material suppliers with whom they associate can’t be said to have worked very well. Bewicke told the audience that in the lower end of the market, ways to cut corners have proliferated rather than the reverse.

“I’m concerned about the prevalence now of what we refer to as contract warehouse distributors. They bring in material on which they do no testing and they move very large amounts of product at very low costs,” Bewicke said.

Bewicke cited examples of how paperwork could be changed to avoid using names that might raise eyebrows among inspectors. No solvent residue testing is done, no tests for pesticide residues, and there is no stability data, and the material is often held in facilities that would not pass GMP muster. Overhead for these operations is close to zero so these companies can meet the overarching need to compete on price. An extract made to a high level of quality might have as many as 20 control points in its manufacturing process, Bewicke said. Materials sourced through the contract warehouse system will have many fewer. Some of the most profitable brand holders in the North American market source a high percentage of their ingredients this way, Bewicke said.

“We have a tendency to blame China for the quality problems we have in the industry right now. But the owners of these Chinese manufacturing facilities that we blame are business people and they are doing exactly what their customers want. What the US market has been demanding for many years is low prices,” Bewicke said.

What’s to be done

Bewicke said many more efforts like the one represented by the meeting in Utah need to take place to reverse the industry’s quality image. Being transparent about solvent residues would be only one example. In milk thistle extract, he said at he moment that it’s almost impossible to compete with a 100% ethanolic extract because of price. So almost all of this ingredient in the US market is extracted with acetone, though this will often not be stated on the Certificate of Analysis.

Among the other initiatives Bewicke advocated for were:

Before importation

- On site audits of overseas manufacturing facilities

- Validation of supplier’s lab practices

- Conducting tests in the US of at least three batches of each raw material to be purchased

After importation

- Bring material into a GMP compliant facility

- Do a full suite of tests to look for bacterial, pesticide or heavy metal contamination and to look for known adulterants

- Maintain a high level of compliance with GMP documentation procedures and an independent high level GMP certification.

Bewicke said he took on the job of showing at the meeting just how much needs to be done even if the message might be seen as airing dirty laundry. He said he thought it was important for the scope of the challenge to be understood.

“The person who brings the bad news is not always very welcome,” he said.

In spite of the wide scope of quality problems the industry faces however, Bewicke said he believes we now could be at a turning point in this trend: The number of top level companies in the industry taking the lead in quality sourcing is growing, and there is an ever increasing demand for products manufactured to the highest inependently certified standards.

"Once quality becomes the common ground, analytical and adulteration problems, seasonal and other supply chain questions, the adoption of new technologies and regulations, all become shared and easier to resolve," Bewicke concluded.