Dr Oz effect's dark side: Booming demand opens door for adulterated, synthetic astaxanthin

But the way in which the ‘Dr Oz effect’ can spike demand has a potential dark side, too. Supply chains for many dietary supplement ingredients are inelastic, and output can’t be ramped up easily. Additional crops must be sown and new farmers educated, or new wildcrafting stocks must be located. In some cases these supply chains were years in the making.

Ripe for adulteration

It can create a climate ripe for economic adulteration, observers have said. And just such a case seems to have come to pass in the supply of astaxanthin, a potent antioxidant carotenoid. Demand for the ingredient, which had been on an upward trend, increased as much as tenfold practically overnight following a Dr Oz segment in February, 2012 in which Dr. Joseph Mercola touted the ingredient’s benefits. Creative—and unethical—ways emerged to meet that demand, according to Rudi Moerck, CEO of Eustis, FL-based Valensa.

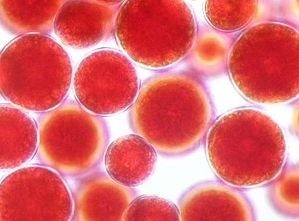

Astaxanthin in its natural form is derived from the algae species Haematococcus pluvialis, and responsible suppliers such as Valensa, Cyanotech, Fuji and Algatechnologies all have submitted NDI notifications on their ingredients. The algae is grown in ponds, bioreactors or a combination of the two, and as a result it takes time and capital to build up production capacity.

But the ingredient is available in synthesized form, too, from suppliers such as DSM and BASF for the animal feed markets, where it is used among other things to impart the red color to the flesh of farmed salmon and trout. This ingredient, which is not marketed for or approved for human consumption outside of the trace amounts found in farmed fish, is about a tenth or less the cost for natural astaxanthin from algae, said Rudi Moerck, PhD, CEO of Florida-based formulator Valensa.

"This low cost carrot dangling is sometimes too tempting for buyers to resist, even though they’d knowingly be purchasing an illegal, adulterated substance," said Joe Kuncewitch, national sales manager for astaxanthin supplier AstaReal, Inc.

Finding its way into supplements

Yet after the big spike in demand, it started finding its way into ingredients meant for the supplement market. Moerck emphasized that no blame can be attributed to DSM and BASF in this instance. What appeared to be happening was that certain Chinese suppliers were mixing some synthesized product diverted from aquaculture with algal-sourced astaxanthin to quickly meet the inflated demand for the ingredient, and some of these examples found their way to Valensa as it sought sources for its own supply, Moerck said.

“When we looked at the samples we had received from China it was obviously a mixture of natural astaxanthin and astaxanthin from the salmon feed industry,” Moerck said. “You cannot tell the difference other than if you take the time to find out what the optical isomers are.”

“We’re seeing start up producers entering the US market, primarily from Asia, and knowing what can go on in countries like China when it comes to quality and safety, this is a huge concern,” said Bob Capelli, vice president of sales and marketing for Hawaii-based Cyanotech.

Safety concerns

Moerck said such counterfeit ingredients raise a safety issue, but that’s not to say that the feed ingredients aren’t high quality products in their own right.

“If you make something synthetically the end product may actually be purer than a natural product. That’s well known. The purity might be 99%. The problem is that 1% hasn’t been tested for human consumption,” Moerck said. For farmed salmon it’s a non-issue because the amount of astaxanthin in each fish serving is so tiny. But in supplements, especially in the current climate in which some backers of the ingredient are advocating for higher and higher doses, it’s a cause for concern, he said.

“We’ve found indications that some companies may be starting to market synthetic astaxanthin in the USA illegally—it is not approved here and, in fact, has never been approved in ANY country in the world for direct human consumption to our knowledge. The reason why companies have to be very careful and source from only a trusted source is that synthetic astaxanthin may have serious safety concerns. Synthetic versions of other, closely-related carotenoids like beta carotene and canthaxanthin, both have displayed serious potential safety concerns previously, and synthetic astaxanthin may very likely prove to have similar concerns. It should be avoided until long-term safety testing has been completed,” Capelli said.

"There are even natural forms of astaxanthin, other than from algae, which are finding their way into the market without NDI. Yeast forms, like Phaffia, and biosynthesized analogues from other sources have been identified. It should be pointed out that all of these astaxanthin varieties can be easily 'fingerprinted' through HPLC assay which Fuji Chemical, our parent company, and other qualified carotenoid labs can ascertain. With the proper equipment and method, the test is so predictive and accurate that we sometimes scratch our heads and wonder how companies can purchase these adulterated forms of astaxanthin and legally stay within GMP compliance if they are truly performing analysis on their incoming raw materials," Kuncewitch said.

Durable demand

The problem is unlikely to abate soon. The demand spike from the show has proved to be durable and now appears self sustaining, as formulators and scientists have discovered new applications for the ingredient beyond its antioxidant potential.

"The Dr Oz effect has not worn off. We’re still seeing strong sales and demand exceeds supply. We’re also seeing more condition-specific applications and products targeting cardiovascular health or joint health combining astaxanthin with other ingredients,” Moerck said.

“We see joint health as a big winner as it’s a huge market that’s dominated by glucosamine and chondroitin which have questionable efficacy.”